VALUE FUND - THIRD QUARTER REPORT

Market Review

The third quarter of 2012 was best summarised by the following cover pages from The Economist:

Uncertainty remains widespread across the global economy. European politicians continue to vacilate and the US elections have only served to divert attention temporarily from several major issues - the approaching expiry of the “Bush tax cuts” and the looming “fiscal cliff” as the media have termed it. The world’s major economic engine, China, also appears to be slowing and is in the process of leadership change.

Separately, our scepticism / caution on investing directly into China remains and is only emphasised when we read in the New York Times that Prime Minister Wen Jiabao and his family have accumulated assets totalling US$ 2.7bln. This is a fascinating article and worth the time for those interested: http://tinyurl.com/wenjiabaohiddenriches

Corporate performance until more recently has largely ignored the global macroeconomic backdrop but there are signs of weakness developing, especially within the global mining sector. Bonds as we referenced in our second quarter investor report are at historically high valuations and in our opinion global equities offer much better value. You might like to read the FT article written by Burton Malkiel which articulates this issue eloquently: http://tinyurl.com/bondbuyers

The Federal Reserve Governor – Ben Bernanke has continued to offer his support to the US economy (and global economy) by maintaining zero interest rates until 2015. This is now referred to as “QE Infinity”. Quantitative Easing (“QE”) is a term designed to distract, the real description is “Printing Money”. History shows that when a government puts its mind to devaluing a currency it usually succeeds. These facts continue to drive our negative view on bonds, however predicting the / a turning point remains elusive. Global equities (and particularly those with brand/franchise power) remain the best alternative in our opinion (which should come as no surprise).

Fund Review

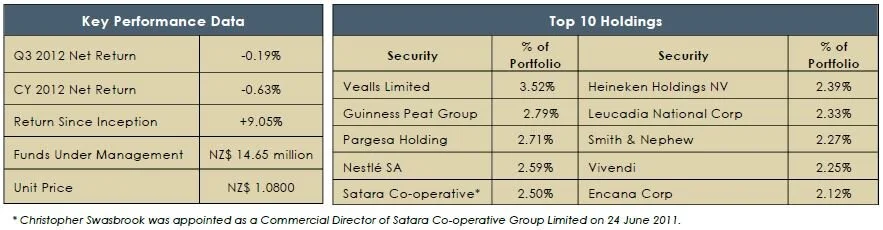

Below we have detailed the ten largest contributors / detractors from performance during the third quarter:

It was not an extremely active quarter for the Fund from the perspective of adding new investment ideas. We added one new name to the portfolio. Marlin Global Limited (“Marlin Global”) in New Zealand. We have released a comprehensive presentation on Marlin Global on our website (and via email) detailing our thoughts on this investment company. Additionally, we have tabled a resolution calling for “termination of the management contract and return all capital to shareholders at Net Asset Value less costs of termination, impairments and portfolio liquidation” for inclusion at the ASM. We do not expect an immediate outcome as our resolution is “non- binding” but we anticipate support from other shareholders and we plan to continue to lobby the directors in an effort to release value for ourselves and other like-minded investors. We exited 15 holdings during the quarter as we continued to rationalise smaller positions and several NZ investments which had rallied strongly. We also executed on the opportunity to reduce Vealls Limited from 9.50% of the portfolio at the end of Q2 2012 to 3.52% at the end of Q3 2012. The Fund ended the quarter with 24.8% cash and 64 holdings in total.

Stock Review - Yahoo

At the end of the third quarter, our investment in Yahoo! comprised 2.10% of the portfolio. Yahoo!, located in Sunnyvale, California, owns and operates Yahoo.com, one of the largest websites in the US. The company generates revenue through display advertising, search advertising and its affiliate network. The company also has two key investments – Alibaba Group and Yahoo! Japan.

On 19 September 2012, Yahoo comprised 2.10% of the portfolio. Yahoo, located in Sunnyvale, California, owns and operates Yahoo.com, one of the largest websites in the US. The company generates revenue through display advertising, search advertising, and its affiliate network. The company also has two key investments - Alibaba Group and Yahoo Japan.

After tax proceeds totaled US $4billion and Yahoo still retains 23% stake in Alibaba Group as the transaction resulted in Alibaba Group retiring shares and thus ownership accretion for Yahoo.

We estimate a remaining value of US $6billion or US $5.00 per Yahoo share on an after-tax basis. Market expectations are for Yahoo to use US $3billion to repurchase roughly 17% of its current market capitalisation.

Based on these numbers its not hard to calculate a sum-of-the-parts valuation of Yahoo in excess of US $30.00 per share versus a price of US $15.975 per share at the end of the quarter. Essentially at current prices we believe investors are receiving the core US business, Yahoo.com and its US $1.7billion in EBITDA for free!

We trust this explains succinctly why/how we see value in Yahoo.

Thank you for your continued interest and support in / for the Fund. We look forward to updating you again on the Fund performance and providing further insight into a selection of the underlying investments within the portfolio soon.

“The only source of knowledge is experience.”

- Albert Einstein

Yours Sincerely,

Elevation Capital Management Limited