VALUE FUND - FOURTH QUARTER REPORT

Market Review

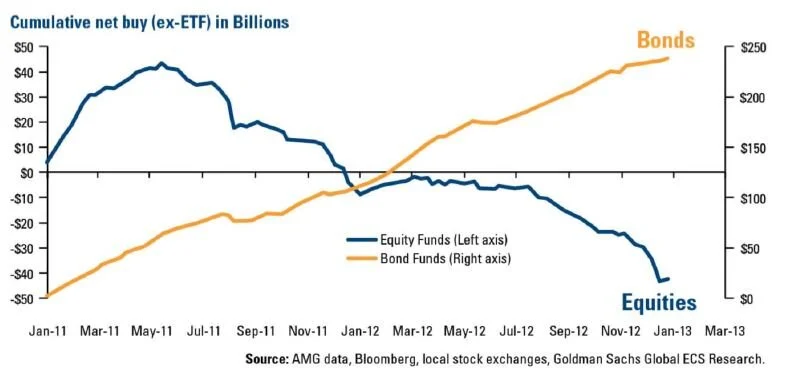

Global equity markets climbed a wall of “macro worry” in 2012 and finished the year on a positive note, which has continued into January 2013. As we now know, just after the New Year the US Congress avoided the “fiscal cliff” but once again politicians “kicked the can down the road”, setting the stage for further budget and debt show-downs. This quote from EU President, Jean-Claude Juncker, “We all know what to do; we just don’t know how to get re- elected after we do it” best summarises the political situation the developed world over. Monetary policy has continued to drive markets and caution remains warranted. Assets that are traditionally considered safe (i.e., US Treasury securities and investment-grade corporate debt) have become more risky as interest rates remain at very low levels on a global basis, and now represent return-free risk, particularly in real terms (I.e., after inflation). This has created what we continue to believe is a unique opportunity for investors with a longer-term horizon to invest in high quality large capitalisation global equities. The chart below highlights the fund flow data and the movement of “the herd” since January 2011:

To quantify the above chart with numbers, since the start of 2011, investors put US$ 248 billion into bond funds and redeemed close to US$ 50 billion from equity funds.

The numbers detailed above (and our internal valuations) suggest to us that the contrarian investment opportunity at present remains in high quality large capitalisation global equities. The Fund is extremely well positioned to reap the potential benefits of owning a portfolio of well financed, dividend paying global companies. We have very few assets remaining in NZ and Australia (currently as at 31 December 2012 – 11.8% of the portfolio), and we expect this to continue to decrease in 2013.

We also remain un-hedged on all foreign currency exposures and therefore stand to benefit if and when economic recovery gains traction in the US and, in time, Europe.

While the continued appreciation in the NZ dollar has muted returns by an estimated 4.9% in 2012, we continue to believe that the strength of the NZ dollar presents a compelling long-term opportunity for New Zealanders to diversify and invest into undervalued, high quality global companies in the US and Europe (in particular).

Recently ther have been some suggestions in the media that the New Zealand stock market has entered a “bubble.” What we prefer to highlight to investors (and potential investors) is that within a a global equity market context the words “bubble” or “expensive: cannot be used when describing many international companies we have within the portfolio at present. For example, Cisco Systems (“Cisco”) sold for 100x earnings in 2000 and paid no dividend. The 10-year Treasury at the time was yielding 6.5% . Today , Cisco sells for less than ~9x earnings (if you deduct the cas on its balance sheet) and pays a 3% dividend. The 10-year Treasury yields 1.78% (as at 31 December 2012). Where is the bubble? It is not in the global stock markets. Large capitalisation global equities yielding more than bonds in all likelihood is a “gift” that will keep on giving many years ahead.

[Cisco currently accounts for 2.25% of the portfolio as at 31 December 2012].

Additionally, institutional and wholesale investment funds still seem under-invested. Stocks make up about 35% of assets at US private pension funds, below the long-term average near 44% accounting to recent industry data.

Fund Review

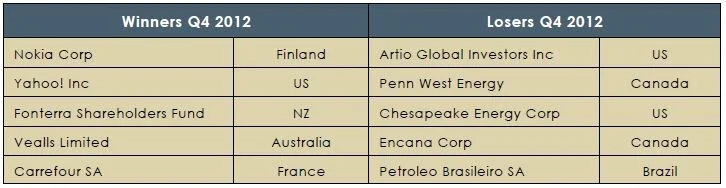

Below we have detailed the five largest contributors / detectors from Fund performance during the fourth quarter:

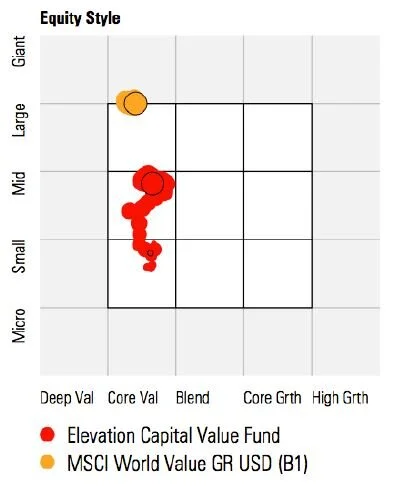

In terms of the Fund’s portfolio, 2012 was a year of continued change as we upsized the portfolio from small capitalisation value stocks towards large capitalisation value stocks. (This decision has already started to bear fruit with a + 4.48% net return for the Fund in January 2013.) The chart below from Morningstar shows how we have shifted the market capitalisation exposure of the portfolio from a weighted average market cap as at 31 December 2010 of NZ$ 544 million to NZ$ 12.8 billion as at 31 December 2012 without compromising our value style:

The Morningstar chart also shows that we remain significantly different from the benchmark index MSCI World Value. This difference is called “Active Share” within the funds management industry. The term was formalised in a 2009 Yale research paper by Antti Petjisto & Martijn Cremers.

“Active Share” as defined by Pejisto and Cremers is the percentage of a fund’s weight adjusted portfolio that differs from its benchmark. As at 31 December 2012, Elevation Capital Value Fund had an “Active Share” of approximately 96%, or put another way only 4% of our portfolio showed any commonality with the iShares MSCI Value Index ETF (which we use as a proxy for the MSCI World Value Index in our calculations).

It is our understanding that Morningstar and other fund research companies like Lipper are starting to publish “Active Share” figures as it enables an investor to assess if a manager is truly active versus closely tracking an index and therefore worthy of an active management fee.

Barron’s recently quoted Cremers as saying that “Funds with high active share actually do outperform their benchmarks”. The 2009 study found that, between 1990 and 2003, funds with “Active Share” of at least 90% -- meaning that no more than 10% of their portfolios mimicked the benchmark -- outperformed by 1.13% per annum after fees. Funds with an “Active Share” below 60% consistently underperformed by 1.42% per annum after fees.

While no measure is perfect and “Active Share” will have its critics, the key point remains that you cannot beat the index (any index) if you look exactly like it.

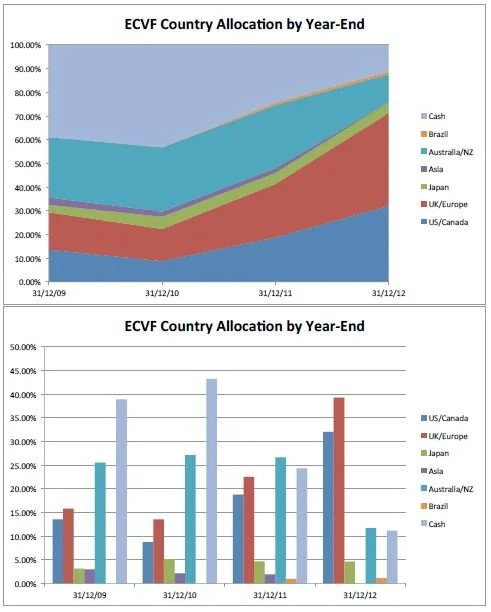

During the past year we have taken advantage of our cash balance and invested in a number of high quality global and European companies as the charts below illustrate:

As at 31 December 2012, our cash balance totaled 11.20% as we funded some net outflows, additional purchases of existing positions and new investments in Mondelez (1.40%) and Danone (0.3%).

We do anticipate rebuilding our cash levels as (i) corporate actions and/or (ii) new inflows permit. Our portfolio remains highly liquid outside of Satara Co-operative Group Limited. However, there is some recent newsflow on this stock, which we feel is important to highlight.

Satara Co-operative Group Limited (“Satara”)

Satara accounted for 2.86% of the portfolio as at 31 December 2012. Christopher Swasbrook is currently a Commercial Director of the Company which limits what we can say on the Company but we delayed this report to inform you that:

“On 4 February 2013, Satara announced to the NZX that it had entered into a merger agreement with Eastpack to create an industry leading co-operative. The Fund will be voting in favour of this merger. The vote is scheduled for 22 February 2013. Should the merger proceed, the Fund will receive NZ$ 0.56cps + a NZ$ 0.05cps special dividend in March 2013 with a further NZ$ 0.04cps payable in June 2014.”

We will update all our investors as to the outcome of the shareholder vote after the results are announced to the NZX.

Sector Review

It is an interesting fact that by the end of 2012, the US is going to be exporting more energy than it imports. This has been driven by increased use of “fracking” (hydraulic fracturing) to produce oil and gas. This will also have an extremely positive impact on the US manufacturing sector, the US balance of payments and on US growth in general.

US energy costs are now half those in the rest of the industrialised world, and natural gas costs only a third as much as it does on a global level. The US invested US$ 138bln in the energy industry in 2011. Russia and Saudi Arabia have roughly the same amount of annual liquid-energy production, but Russia invested only US$ 10bln, and Saudi Arabia US$ 5bln in 2011 (Source: Barron’s).

Over the past six years, US production of petroleum and natural gas has increased from 15mln barrels of oil-equivalent (boe) a day to 20.1mln, a 20-year high. Over the same period, imports have fallen from 14mln boe a day to 8mln, a 25-year low.

By 2020, the US will become the world’s biggest oil producer according to the International Energy Agency (IEA). In a further change, graduates from the South Dakota School of Mines and Technology (Acceptance Rate: 88%) – now command a median starting salary 16% higher than that of Yale graduates (Source: Barron’s).

This “edge” will remain for decades and is one principal reason why we are bullish on the US long term.

What has been good news for the overall US economy has been bad news in the short-term for the energy sector – in particular natural gas prices.

As natural gas prices plummeted in 2011/2012 we became increasingly interested in the sector and today ~17% of the Fund is invested in the oil and gas sector. We prefer to invest across a number of stocks within the sector as a risk mitigation strategy. However, each stock within the portfolio has its own unique asset base and story.

Three examples from within the portfolio at present:

Encana is the third largest North American natural gas producer (Market Cap US$ 13.6bln). Its operations are located in some of the most prolific natural gas producing areas. However, the low natural gas price has resulted in a depressed stock price due to the near-term earnings impact of lower gas prices, but for those prepared to take a slightly longer-term view and investigate recent industry transactions, especially given Encana’s valuable resource base, it is not beyond the realms of possibility that Encana could be valued at a +50% premium to the prevailing market price.

Chesapeake is the second largest North American natural gas producer (Market Cap US$ 14.6bln) Chesapeake was created in the last two decades by a swashbuckling entrepreneur called Aubrey McClendon and, like Encana, has come under pressure due to the declining natural gas prices. As the stock fell, activist investors began exerting pressure on the Board and this has resulted in both boardroom changes and recently the ouster of McClendon. This may pave the way for a progressive break-up / sale of Chesapeake. Once again utilising industry transactions, the value of Chesapeake is potentially materially higher than the current stock price and our cost basis.

Hess is a US-based global integrated energy company (Market Cap: US$ 23bln) that is standing at the crossroads. The company cannot decide whether it wants to be a major international oil and gas company, or a mid-sized independent oil and gas prospector in the US. We purchased our stake in Hess as the market continued to become increasingly despondent on the sector. Fast-forward six months and the company is now the target of an activist investor who suggests the company could have a value of +US$ 100 per share. (Note: the Fund purchased Hess below US$ 45.00 per share – last sale ~US$ 66.00 per share). Clearly, we wish them all the best with their proxy fight for Board representation.

Closing

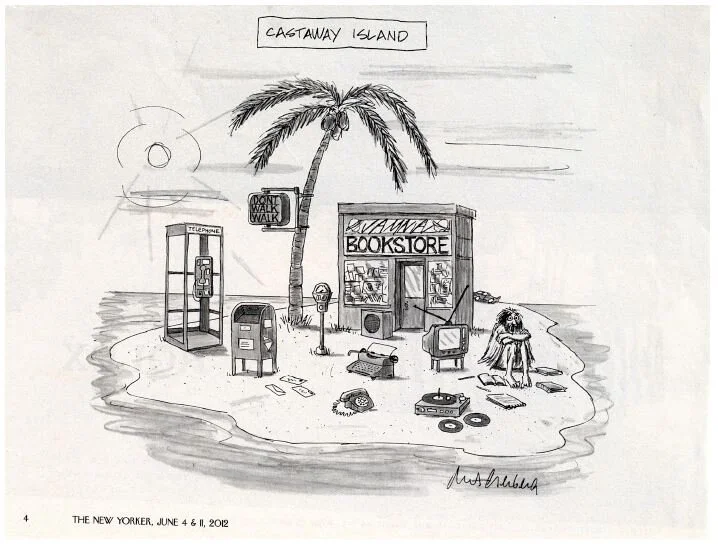

Thank you for your continued interest in and support of the Fund. Our portfolio is mostly comprised of a large number of high quality well-financed global businesses, which we expect will continue to deliver both earnings and dividend growth in the years ahead. Our current portfolio is not located on “Castaway Island” (as detailed in the cartoon below from The New Yorker), but we do continue to seek out companies with enduring franchises and assets that for one reason or another maybe out of favour with “the herd”.

“Nothing is more obstinate than a fashionable consensus.”

-Margaret Thatcher

Yours Sincerely,

Elevation Capital Management Limited