VALUE FUND - FIRST QUARTER REPORT

Important note to our investors and other readers: Elevation Capital’s Quarterly Investor Reports are designed to inform our investors about recent portfolio developments and provide our views of the market environment. Our reports are not investment recommendations for the general public. Please read the disclaimer at the end of this document in its entirety. Elevation Capital Management Limited (as Manager of the Elevation Capital Value Fund) may also trade in and out of any position discussed and undertakes no duty to update anyone, except to the extent we are required to make filings with any market regulator. Investors who chose to take action based on our investment ideas do so at their own risk.

Market Review

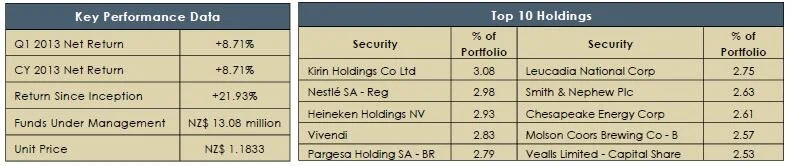

The Elevation Capital Value Fund had a very strong start to the year (+8.78% in Q1 2013 vs. the Fund’s benchmark (MSCI World Value Index +2%) +6.21%) driven by strong underlying stock performance plus mergers and acquisitions (“M&A”) within the portfolio (specific stocks detailed below). The Manager also announced (and paid) as at 31 March a 2.5 cents per unit distribution to all Unitholders. This equated to an annual yield of 2.10% as at 31 March 2013.

As the Barron’s covers from Q1 2013 (above) indicate, there is increasing bullishness on stocks. We have also detailed some quotes from Warren Buffett (above) which serve to remind investors (and ourselves) that we must all continue to focus on the fundamentals of each individual stock which we own and their respective underlying merits. Focusing solely on what the herd is doing/thinking is largely an exercise in futility and while we are not oblivious to the global environment and its challenges, we continue to focus on each underlying franchise, balance sheet, dividend stream and special situation & potential catalyst/s.

Fund Review

Below we have detailed the five largest contributors/detractors from Fund performance during Q1 2013:

M&A was a key feature of the Q1 2013 in the portfolio, with the following stocks receiving bids/takeover offers or successfully closing announced mergers:

We are particularly pleased to consummate our exit from Satara Co-operative Group Limited given our long-standing and (at times) public battle with the Board and past management over the history of poor capital allocation and governance within the Company. Satara (to us and should to others) serve/s as a lesson of the caution required with the risks of agriculture (via disease) and, despite the presence of a strong tangible asset base, the ever-present risks of poor management with little regard to shareholder (investor) returns. The table below highlights how we have shifted our portfolio focus over the past 12 months from small capitalisation companies (with a bias to NZ and Australia) to a more concentrated portfolio of global large capitalisation companies. This shift has been driven by, our desire to own a portfolio comprised of high quality stocks that are market leaders, low-cost producers, companies with pricing power, with strong balance sheets and the ability to self-fund growth (e.g. Nestle, Heineken Holdings, Kirin, Molson Coors) and what can also be classified as special situations (e.g. Kirkcaldie & Stains, Monster Worldwide, True Religion, Starz, Vivendi.)

There are several other points which investors (and prospective investors) should be aware of with regard to the Fund’s portfolio:

The Manager trimmed/reduced a number of positions into Q1 2013 market strength (detailed below). We also increased holdings in those stocks where we felt the market was underestimating future prospects (also detailed below):

Portfolio concentration in global stocks has increased during the past year which is reflective of the number of positions decreasing from 99 to 48 and the average market capitalisation increasing from NZ$ 3.2bln to +NZ$ 15bln;

As a direct result of this shift in the portfolio, liquidity has greatly improved (this was a past criticism of the Fund and Manager) which we felt was somewhat misplaced and is clearly misplaced if it remains the perceptiontoday;

The Manager continues to maintain a conservative cash position which affords us both opportunity but also allows us to deal with fund inflows / outflows without incurring unnecessary transaction costs and portfolio turnover (which are both the enemy of the investor). As at 31 March 2013, cash accounted for 25% of the portfolio;

When one considers the current portfolio, the historical average cash balance (+30% average since inception), currency hedging position (NIL) and the historical cumulative returns, the Fund offers current investors (and potential investors) in our opinion a very attractive risk/reward proposition for an investment in global equities and special situations.

The Fund acquired new positions in the following stocks:

Coach, Inc.: was founded in 1941 as a family-run workshop in a Manhattan loft. The Company is now a global luxury goods manufacturer and retailer. As of June 30, 2012, there were over 500 Coach stores in the United States and Canada, and over 300 directly operated locations in the UK, Japan, China, Singapore, Malaysia, South Korea and Taiwan. Beyond the Company’s direct retail businesses, Coach has also built a strong presence globally through Coach boutiques located within select department stores and specialty retailer locations in North America, and through distributor-operated shops in Asia, Europe and Latin America. In 1999, Coach launched its on-line store at www.coach.com and currently offers its products on-line in three countries: the U.S., Canada and Japan, with informational websites in 20 other countries. The Fund acquired its position in Coach after the market became despondent on its growth forecasts and increasing competition from the likes of Michael Kors. This is despite the Company having repurchased ~25% of its share on issue in the last 5 years and still having close to US$ 1bln of net cash on its balance sheet. The Company continues to generate significant free cash flow each year (+US$ 1bln in FY2012) which it can reinvest in its global footprint or continue to repurchase shares.

The Fund opportunistically acquired its position (1.02% of FUM as at 31 March 2013) in Coach at a cost of US$ 48.23 [Last sale: US$ 57.42 - 26 April 2013].

MetLife, Inc.: Founded in 1868, MetLife is a leading global provider of insurance, annuities and employee benefit programs, serving 90 million customers. Through its subsidiaries and affiliates, MetLife holds leading market positions in the United States, Japan, Latin America, Asia, Europe and the Middle East.

The company appears to trade at a deep discount to other major insurers, and a discount to its historical valuation. In our assessment, MetLife’s balance sheet is sound with cash at US$ 15.7bln versus long-term debt at US$ 26.5bln as at 31 December 2012. The Company has also recently divested its banking subsidiary (to GE Capital) and is in negotiations with the US Treasury to have itself excluded as being “systemically important” which would allow the Company to return excess capital to shareholders. Recently, the Company also made a strategic and opportunistic acquisition in Chile of AFP Provida, which has very attractive long-term demographics and a sound rule of law (relative to other “emerging markets”). This US$ 2bln acquisition was internally funded and compares very favourably in price terms to Principal Financial Group's recent acquisition of Cuprum a leading Chilean pension company. As a result of the current low interest rate environment and uncertainty about the Company’s future ability to accelerate capital returns to shareholders via share repurchases and or other mechanisms for capital return, MetLife trades at a steep discount to book value, which was US$ 57.03 per share as at 31 March 2013. Despite on-going negotiations with the US Treasury, the Company recently increased its dividend by 49% from US$0.185cps to US$ 0.275 per quarter (previously the Company only paid an annual dividend).

The Fund opportunistically acquired its position (0.87% of FUM as at 31 March 2013) in MetLife at a cost of US$ 36.96 [Last sale: US$ 38.53 - 26 April 2013].

Scholastic: Scholastic Corporation is the world’s largest publisher and distributor of children’s books and a leader in educational technology and related services and children’s media. Scholastic creates quality books, print and technology-based learning materials and programs, magazines, multi-media and other products that help children learn both at school and at home. The Company distributes its products and services worldwide through a variety of channels, including school-based book clubs and book fairs, retail stores, schools, libraries, on-air, and online at www.scholastic.com. The Company has the exclusive US publishing rights for the Harry Potter and The Hunger Games book series. Currently, the stock is trading near its book value, as investors are worried about the constrained educational spending by schools/parents and the secular changes to the publishing industry. Our current view is that the Company’s strong economic moat in school publications, and its ability to sign blockbuster franchises provides the company with a sustainable long-term earnings profile (with growth), which will not disappear overnight. Additionally, the Company has a net cash position.

The Fund established its position (0.67% of FUM as at 31 March 2013) in Scholastic at a cost of US$ 27.99 [Last sale: US$ 26.66 - 26 April 2013].

Starz: is a leading integrated global media and entertainment company with operating units that provide premium subscription video programming on domestic U.S. pay television channels (Starz Networks), global content distribution (Starz Distribution) and animated television and movie production (Starz Animation), www.starz.com. We are huge fans of John Malone, the Chairman of Liberty Media, who was the driver behind the spin-off of Starz from Liberty Media. Mr. Malone has a proven successful track record in the industry, and in tax-efficiently generating shareholder value for himself and those who invest with him. The medium term catalyst for this stock is the potential for the Company to be taken over by various potential media partners such as Disney, Sony, Comcast etc. We consider this investment another special situation.

The stock price moved up quickly as the Fund established its initial position in Starz in early February (0.50% of FUM as at 31 March 2013) at a cost of US$ 16.71 [Last sale: US$ 23.91 - 26 April 2013]. We hope to get the chance to add to this position opportunistically on any market weakness.

True Religion: is a jeans company, founded in 2002 by industry veteran Jeffrey Lubell. The founder, chairman and chief executive officer built the brand based on the principles of quality, American-made authentic denim with timeless appeal and a vintage aesthetic. It was an instant favourite for everyone from fashionable stay-at-home moms to über-celebrities such as Angelina Jolie, Jessica Simpson, Megan Fox, Kate Hudson and Jennifer Lopez as well as a myriad of stylish male stars. True Religion is currently sold at 125 standalone stores worldwide and is distributed to 50 countries on six continents. The company went public in 2003 and is listed on the NASDAQ. The Company’s stock price dropped 40% in 2012 as the Company had two negative quarterly earnings surprises. After this decline, we began researching the stock. Currently, the Company has no debt, and has US$ 186mln in cash (56% of Book Value) that could be returned to investors through a special dividend. The stock also provides a reasonable +3% annual dividend yield. Lastly, the Company has generated US$ 40mln – US$ 50mln of free cash flow annually for the last four years versus a current market capitalisation of ~US$ 700mln.

In early October 2012, the Company announced that it would explore selling itself, and the stock jumped 20%+. We waited patiently, and in Q1 2013 we established our initial position in this special situation (0.60% of FUM as at 31 March 2013) during market weakness at a cost of US$ 25.80 [Last sale: US$ 27.65 - 26 April 2013].

Closing

Thank you for your continued investment and interest in the Fund. Our portfolio is extremely well positioned to continue to deliver attractive risk-adjusted returns for long-term minded investors. The portfolio is an eclectic mix of large capitalisation global franchise stocks, which we expect will continue to compound earnings, dividends and intrinsic value at attractive rates over time as well as special situations, which have catalysts in place (or we plan to become a catalyst) to potentially unlock value for shareholders.

Yours Sincerely,

Elevation Capital Management Limited