VALUE FUND - SECOND QUARTER REPORT

Market Review

The second quarter of 2012 is easily summarised with the following caroons/pictures:

In terms of macroeconomics, the continued deluge of news headlines from Europe coupled with signs of slowing growth in China and fiscal issues in the US continued to weigh heavily on financial markets.

Turning our attention briefly to Australia, Morgan Stanley have recently tabled a report where they estimate the Australian Dollar has a premium of US10c – 15c in its pricing due to “safe haven” flows. There are now suggestions that the RBA should intervene to cap the currency. According to Morgan Stanley this makes sense, but they do not believe RBA action is imminent. We view such a move in Australia (or New Zealand) for that matter as unlikely given the size of the market versus our respective Central Banks.

However, it raises the question (in our opinion) for New Zealand. “What is the perceived “safe haven or high-yield” premium in our currency as well?” If there is indeed a premium (which we believe there is) can anything be done to ameliorate this effect as it does have negative impacts on the domestic economy.

In terms of opportunity set for investors we must confess to sounding like a broken record. Global large cap equities are (in our opinion) the most attractive and this is what we have continued to execute on within the Fund. (Note: we now only hold 1 stock in Australia and, as at the time of writing, 6 stocks in NZ.)

Outside of valuation specifics we believe the following charts/factoids provide support to our overriding view that there seems to be a “bull-market in uncertainty” with regard to equities.

Stocks remain the least favoured asset class at present.

Few times in history have S&P 500 stocks yielded more than 10 year U.S Treasury bonds.

Beer versus Bonds? The yield of Molson Coors vs. US 10yr Treasury.

Additional interesting factoids:

Bond funds have now attracted more money than stocks funds every year since 2007;

There have been outright net redemptions from stock funds for the last five years;

A British actuary recently told the FT – “there are not enough bonds in the world”;

The Republic of Lebanon is single-B-rated and its bonds currently yield 5.79% (as at 1 June 2012) versus a single-B-rated US corporate at 8.29% (as at 1 June 2012). Admittedly, Lebanon does have a growing labour force, which is clearly positive but on the negative side it does border Syria. Even more interesting inflation is running at 4%, it has a current account deficit of 14% of GDP (compared to 9.7% for Greece) and a ratio of government debt to GDP of 136.2%;

Petronas – Malaysia’s state-owned oil and gas company recently paid a 77% premium to purchase Calgary-based Progress Energy Resources. Why such a large premium? LNG (liquefied natural gas) commands 6x the price in Asia that gas does in North America. (Note: the fund owns Penn West Energy [1.12%], Canadian Natural Resources [1.34%] and Encana [2.14%] all based in Canada. The Progress transaction supports our thesis that these stocks all trade at sizeable discounts to a reasonable estimate of intrinsic value or potential M&A values based on recent transactions).

Fund Review

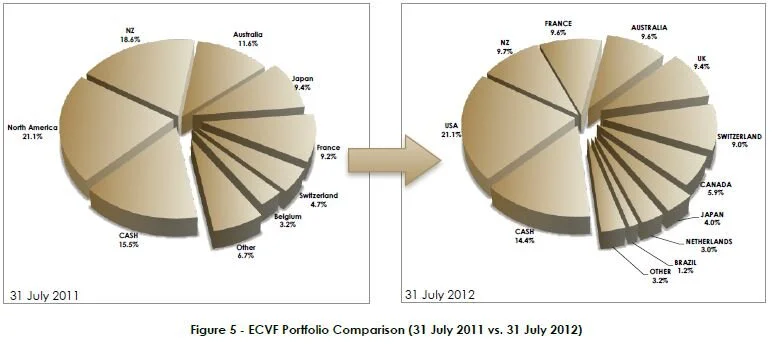

Given what we believe to be attractive valuations on offer in US & European global companies, we continued to reduce investment exposure to New Zealand and Australia with the aim to redeploying capital towards Northern Hemisphere markets. This has continued in August.

You will see from the charts below how our investment exposure (by region) has changed over the past year.

We have also prudently maintained cash levels and taken profits in a number of smaller holdings within the portfolio, which also enabled us to increase our weightings to those stocks where valuation/s became even more attractive (Examples including BP, Carrefour, Canadian Natural Resources, Encana, Heineken, Molson Coors, Pargesa, Petrobras, Vivendi). Additionally, we also acquired four new stocks within the portfolio:

Stock Review - Cisco Systems (CSCO)

Following is a slide we produced for the New Zealand Shareholders’ Association Annual Meeting (11 August 2012) on Cisco Systems, which we feel clearly highlights the key metrics of the stock and its current attractiveness. While we understand Cisco faces challenges in the technology space, it is important to remember that the company still has a strong core business, even assuming some loss in market share from the current 77%. Cisco has an estimated US$ 5.50+ per share in cash. When all but US$ 5bln of cash is backed out, the company trades on a very conservative PE of 5.93x and has a current dividend yield of 2.9%. With these multiples, explosive growth is not required – just some solid execution on current management plans. If this happens, then it is reasonable to expect a valuation more in line with the market as a whole which would provide a price of ~US$ 23.00 versus our cost basis of US$ 15.69 per share - (Last Sale ~US$17.16).

Other Updates

Satara Co-operative Group (NZ): It is important to highlight four points – (i) we carry our investment in Satara at NZ$ 0.30c in our accounts as at 31 July 2012 – this is a sizeable discount to the last sale of NZ$ 0.40c but this was the prevailing bid at month-end. This pricing movement accounted for the majority of the fund’s negative NAV movement in July; (ii) Satara has publicly announced its intention to review its capital structure. While there are no guarantees that this process will yield any result, it is a positive step by the Company to acknowledge that a review needs to be undertaken as the current structure does not permit the true value of the infrastructure assets to be recognised; (iii) Christopher Swasbrook remains a Commercial Director of Satara;, and (iv) Satara was recently written up in an international small cap blog called “Oddball Stocks”:

http://www.oddballstocks.com/2012/08/there-is-something-sweet-with-this.html

Wakefield Healthcare: The Fund held a +1% position in Wakefield Healthcare, which has languished below Net Tangible Assets (~NZ$ 4.80 per share) for some time now. It was not all that surprising to see that the two major shareholders have now formed a JV to take control of the company with a partial takeover offer at NZ$ 6.00 per share. This is another example that a great deal of patience and fortitude is required in small and mid-cap stocks. We have taken the opportunity to exit the stock at a discount to the bid price given the low likelihood we would be able to exit 100% of our holding into the partial bid.

Financial Statements: The financial statements for the Fund/s were lodged at The Companies Office on 31 July 2012. These were also emailed to all unitholders in the Fund. If you did not receive them you can source them at: http://www.elevationcapital.co.nz/images/reports_monthly/ecvf%20%20financial%20statements%20-%2031%20march%202012%20-%20web%20version.pdf

New Prospectus: we are set to register and publish a new Prospectus and Investment Statement on or before 7 September 2012. This will be sent to all unitholders via email (with links) to the documents on our website.

Sir Henry van der Heyden: After five years as a Director of Elevation Capital Management Limited, Sir Henry has decided to depart our Board on 31 August 2012. Henry is also stepping down as the Chairman of Fonterra Co-operative Group and has a number of new directorships, which he has either committed to or is actively considering. We wish him well for the future and thank him for his sound counsel over many years. There are no other changes to the directors of Elevation Capital Management Limited.

Thank you for your continued interest and support in/of the Fund. We thought we would leave you with the following quote which we feel aptly summarises our views at present.

“I know what is around the corner – I just don’t know where the corner is”

- Kevin Keegan, Former International Footballer and Manager of England

Yours Sincerely,

Elevation Capital Management Limited