INSIGHTS

Chart of the Week

Source: Visual Capitalist

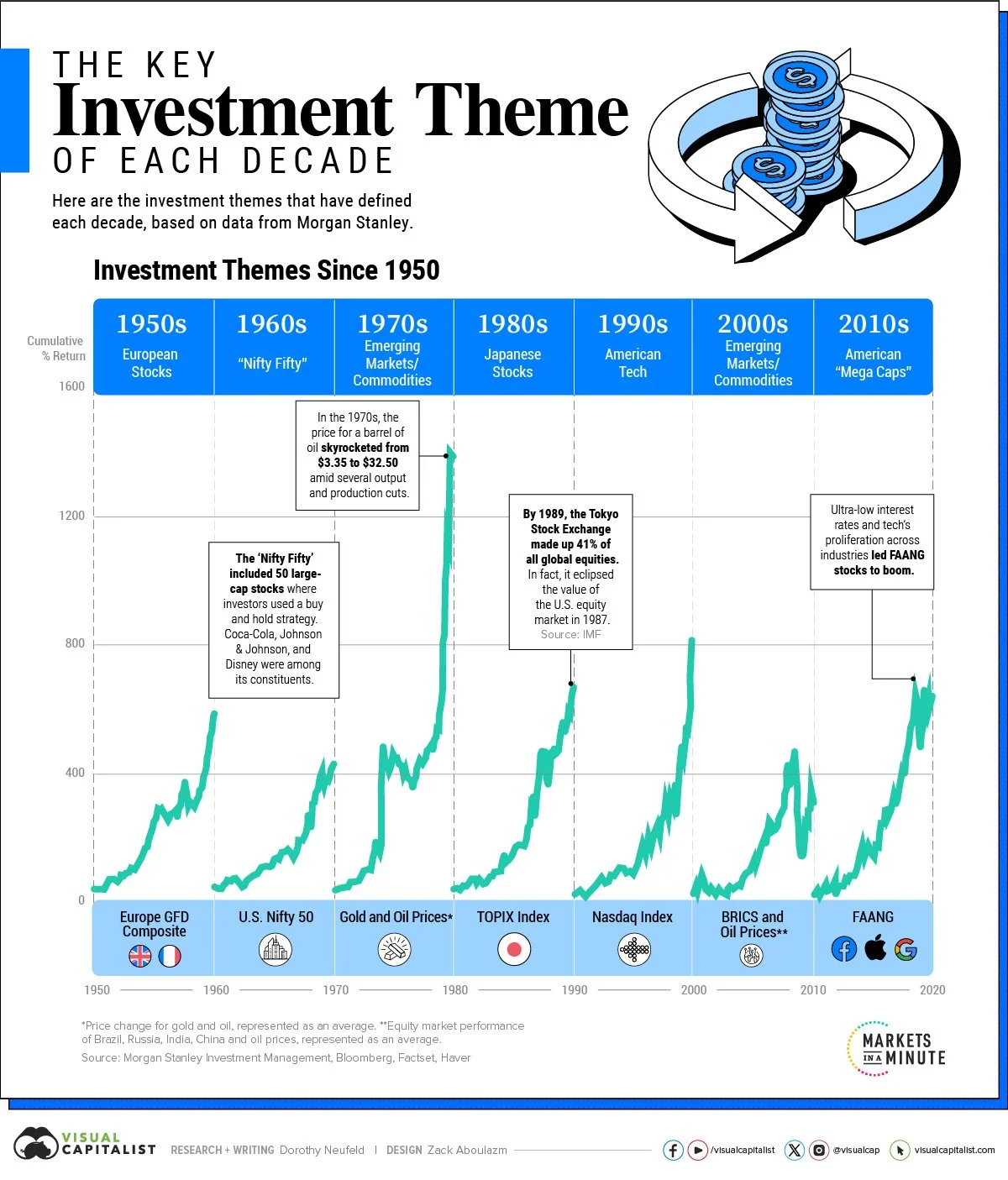

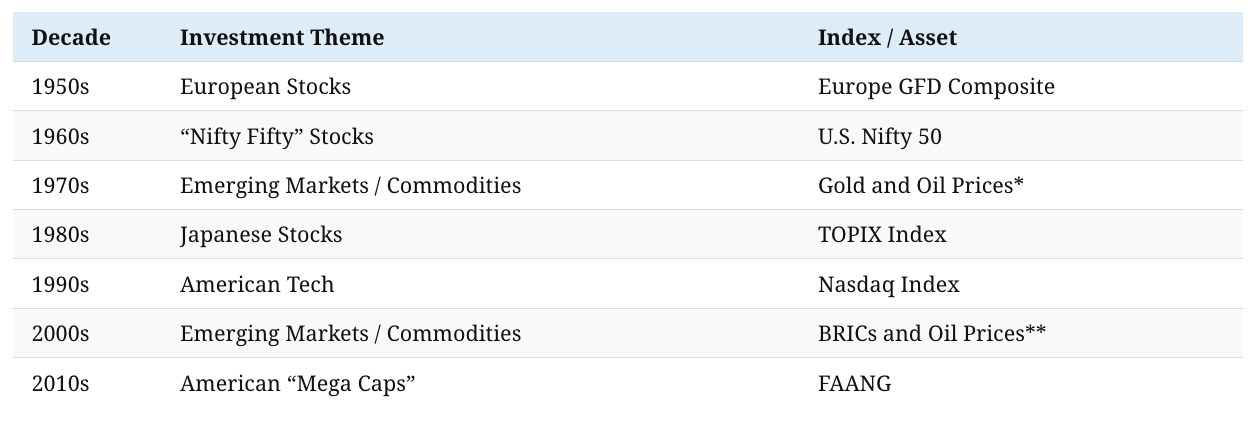

Investment Themes by Decade

These decade-defining themes are often the product of a confluence of factors, including the macroeconomic environment, geopolitics, monetary policy, or other structural shifts like technological disruption.

Here are the central investment themes since the 1950s, each with at least 400% cumulative returns over each period:

*Price change for gold and oil, represented as an average. **Equity market performance of Brazil, Russia, India, China and oil prices, represented as an average.

The 1950s saw a boom in European stocks during the post-war recovery. This was fueled by significant investment from corporations and governments as Europe became more integrated.

Then in the 1960s, investors poured into blue chip stocks in the “Nifty Fifty” including Johnson & Johnson, Disney, and Coca-Cola. The main premise was that these strong franchises would deliver high returns over the long run. During the 1973-1974 bear market, shares cratered.

As oil skyrocketed from $3.35 to $32.50 through the 1970s amid production and output cuts, commodities dominated, along with emerging economy exporters of oil and gold.

Later, through the 1980s, Japanese stocks dramatically increased. In 1989, the Tokyo Stock Exchange made up 41% of all global equities. It had eclipsed the value of the U.S. equity market just two years earlier.

In part owing to strong U.S. economic growth, American tech stocks flourished through the 1990s. While many high-flying tech stocks were wiped out during the crash in 2000, some still remain today. Qualcomm, which jumped 2,620% in 1999, is a multi-billion dollar semiconductor company. Amazon and Cisco were other survivors of this era.

Pivoting from growth assets, investors returned to commodities and emerging markets over the 2000s, this time with BRIC economies—Brazil, Russia, India, and China. The 2010s saw the rise of FAANG stocks as tech proliferated across countless industries.

Givaudan SA: The Flavours & Fragrances Frontrunner

Givaudan (GIVN:SWX, Market Capitalisation: CHF 26.59bn), is the world’s largest company in the Flavours and Fragrances (F&F) industry. A Swiss multinational manufacturer, Givaudan specialises in creating unique tastes and smells used in a wide array of consumer products, ranging from food and beverages to cosmetics and home care products. The company operates in two business divisions; Taste & Wellbeing and Fragrance & Beauty. Givaudan was officially formed in 2000, via a spin-off from global pharmaceutical giant Roche, listing on the Swiss Stock Exchange (SWX). Today, Givaudan maintains a leadership position within the F&F industry, commanding +18% global market share and operating in all regions of the world.

The Elevation Capital Global Shares Fund currently holds shares in Givaudan SA.

Kering SA - Luxury Conglomerate

Kering SA is a luxury conglomerate which owns Gucci, Balenciaga, Bottega Veneta, Yves Saint Laurent, Alexander McQueen and, a number of other renowned luxury brands.

Gucci just last week unveiled its new collection with a new designer: Sabato De Sarno.

Balenciaga with Demna at the helm continues to surprise.

Read our Research on Kering SA from July 2022 here.

Hérmes SA - Latest Fashion Show

Hérmes SA is currently the largest position in the Elevation Capital Global Shares Fund - watch highlights of their latest fashion show.

Read our Research on Hérmes SA from June 2022 here.

Moncler - Brand of Extraordinary

The Elevation Capital Global Shares Fund currently holds shares in Moncler Group.

Read our Research on Moncler Group from August 2022 here.

The Art of Investing: Introducing Adobe

Adobe (ADBE:NYSE) is a dominant player in the creative tools market, with a market capitalization of US$157.09B. Adobe's exceptional business model, enviable market position, and highly sticky products make it an attractive long-term investment opportunity. While concerns about the legacy business following its recent acquisition of Figma may have caused some volatility in stock price, Adobe's consistent growth and high retention rates make it an attractive long-term investment.

Introducing Rémy Cointreau

Rémy Cointreau (RCO: EPA, Market Capitalisation €8.25b) is a company that provides investors with exposure to the growth of luxury markets worldwide. Increasing global income inequality continues to benefit brands at the low end of markets and brands at the top. Rémy sells some of the finest Cognacs in the world, with a full range of brands that serve all the segments between premium and upper luxury. Rémy also sells liqueurs, whiskey, gin and rum, but with a more limited range. In sum, Rémy has a set of global brands which are nearly impossible to replicate, some in excess of 300 years old. This is a vital and insurmountable moat that Rémy can lay claim to; no amount of money can replicate Rémy’s business.

Rémy is well positioned to benefit from an increasingly discerning consumer base situated in high-value, fast-growing categories, which offer the potential for greater margin expansion as Rémy’s substantial operating expenditure (OpEx) abates in the coming years. Compared to its peers, Rémy is far more conservatively leveraged, a symptom of majority family ownership that further separates it from its peers.

Rémy’s valuation has fallen significantly over the last two years, faster than the broader industry and has also faced the same headwinds, an uncertain macro outlook, rising inflation and highly restrictive Chinese lock-downs, which have hit revenues. Despite the ultimately short-term issues that have plagued the industry, we take a longer-term view of Rémy’s potential as a well-run family-controlled company that provides unique exposure to growing affluence, particularly in Asia.

Introducing Alibaba

Alibaba Group, a Chinese conglomerate, has built an ever-expanding ecosystem covering an enormous segment of Chinese economy, including domestic/international e-commerce, logistics, digital banking and payment, cloud computing and digital media & entertainment. Its 2014 IPO shattered all records becoming world's largest IPO at the time. Yet the company has been under scrutiny since 2021 largely due to the tighter regulations imposed by the Chinese Government - especially after its once high flying founder, Jack Ma, publicly chided the country's financial system in October 2020. Its share price plummeted more than 60% thereafter. We added Alibaba to the portfolio in 2021 and subsequently increased this position as we believe Alibaba to be significantly undervalued relative to our assessment of its intrinsic value. To learn more, read our Alibaba Investment Summary Report.

Introducing Moncler

Moncler is a textbook example of how a luxury brand can leverage its history while simultaneously embracing new ideas in order to reinvent itself for a new generation. Poised to be one of the top global luxury outerwear manufacturer, Moncler shows few signs of slowing down during an economic downturn. Investors in the Elevation Capital Global Shares Fund hold an investment in Moncler. We added Moncler to the portfolio in March 2022 during the market sell-off, as we believe Moncler to be undervalued relative to our assessment of its intrinsic value. To learn more, read our Moncler Investment Summary Report.

Sauron is watching…Introducing Palantir

Palantir, a company that renders large strands of data accessible and understandable, is the operating system for governments and large enterprises. Palantir's links to Deep State stem from a 2004 investment from the CIA's venture capital fund and the company has since rapidly increased its commercial client base, alongside its government contracts. Investors in the Elevation Capital Global Shares Fund hold an investment in Palantir. We added Palantir to the portfolio in 2021 and subsequently increased the position during periods of market weakness, as we believe Palantir to be considerably undervalued when one considers its long runway of growth in an hostile geopolitical environment. To learn more, read our Palantir Investment Summary Report.

Further Iconic Fashion Houses added to the Portfolio

There are few fashion houses more iconic than Gucci, Saint Laurent and Balenciaga - all of them have left an indelible impact on fashion from the mid-20th Century till today. One unlikely company owns all these iconic houses: Kering S.A. The company began life as a timber trading company in 1963, and has since become a luxury conglomerate. Investors in the Elevation Capital Global Shares Fund hold an investment in Kering. We once again added Kering to the portfolio during the market sell-off in February 2022, as we believe it is deeply undervalued relative to its intrinsic value and luxury peers. To learn more, please read our Investment Summary Report by clicking the link below.