INSIGHTS

What Worked in 2020? Upwork!

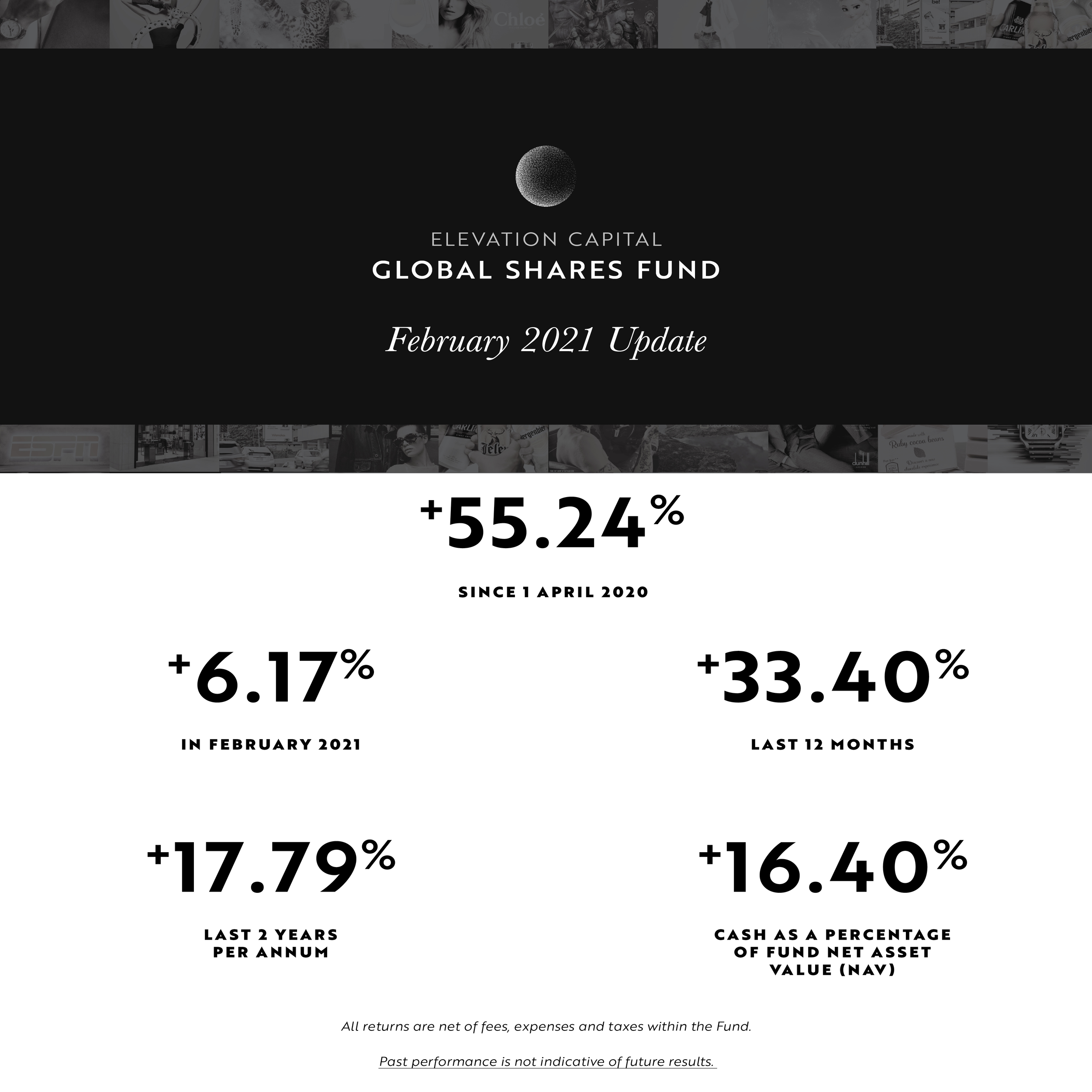

Investors in the Global Shares Fund, managed by Elevation Capital, owned shares in Upwork Inc. [UPWK.NASDAQ], an online marketplace that connects freelancers - including translators, writers, designers and web developers - globally to businesses or individuals that require one-off work.

Elevation Capital purchased Upwork during the 2020 stock market sell-off which began on 20 February and ended on 7 April 2020. This time period was also when Upwork hit its lowest price since its IPO in 2018.

With many workplace and travel closures caused by the Covid-19 pandemic, we recognised the trend of people and businesses engaging in freelance and remote work which we believed Upwork was well-positioned to capitalise on. From May to November in 2020, Upwork saw a +50% increase in corporate and freelancer registrations on its website. Upwork also realised an increase of +24% year-over-year revenue for 20201.

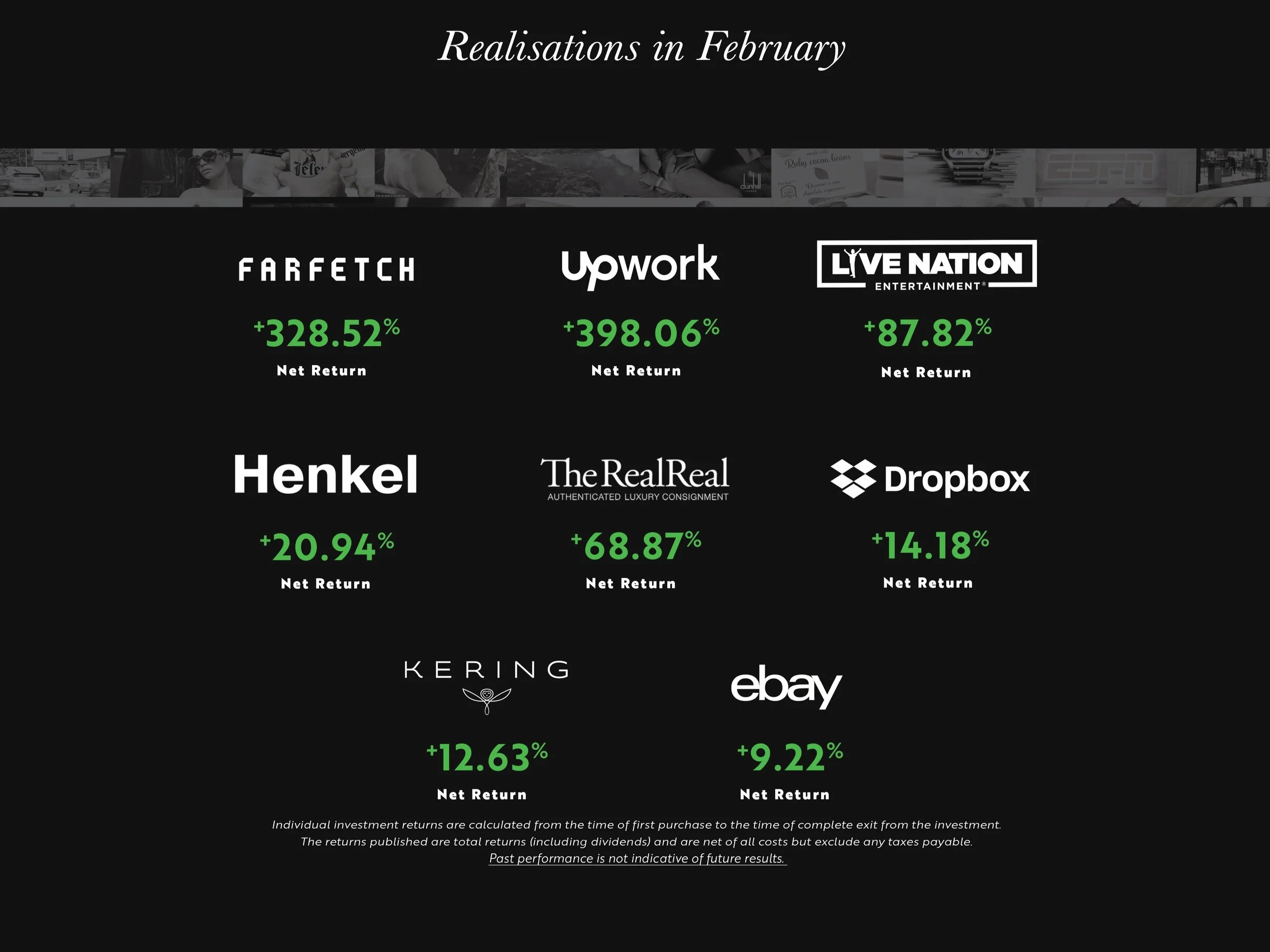

Elevation Capital is constantly reviewing the Global Shares Fund’s investment holdings. In February 2021, we were mindful of the fact treasury yields were once again starting to climb, affecting the cost of capital for all our holdings. Accordingly, we made the decision to exit many of our top performers on a total return basis to realise our gains and bolster our cash position within the Fund as we research new investment opportunities.

The Global Shares Fund exited its entire Upwork investment in February 2021, generating a +398.06% total return for investors in the Global Shares Fund.

Distilling the Beverage Legacy Diageo

Investors in the Elevation Capital Global Shares Fund own a share of Diageo Plc (DGE:LSE), custodian of some of the largest spirits and alcoholic brands in the world. Included in Diageo’s impressive portfolio are: Johnnie Walker, Tanqueray, Gordons, Captain Morgan, Don Julio, Crown Royal, Baileys, Guinness and Smirnoff. The brand efficacy and history contained within Diageo’s portfolio is unparalleled and has helped to establish Diageo as the global leader in the drinks industry.

The Elevation Capital Global Shares Fund previously owned Diageo from 2014 to 2018 delivering a net return of +58.96% (+16.49% per annum). The COVID-19 pandemic has hit the spirits market particularly hard as consumers have been prevented from attending social gatherings and restaurants - two of the key points of sale for alcoholic consumption. This alignment of negative forces presented the opportunity to acquire Diageo at an attractive discount to our sum-of-the-parts valuation range of £36.82 to £43.92, offering +48.40% to +77.02% potential upside from the Elevation Capital Global Shares Fund’s latest cost basis.

Introducing the New Global Shares Fund Website!

We are excited to announce we have updated the look of the Global Shares Fund website and is now live!

Our aim with the new Global Shares Fund website is to:

Make our monthly factsheets, investment return information and performance data even more accessible and transparent to investors

Regularly update our investors on Elevation Capital Global Shares Fund portfolio holdings and our proprietary research

Incorporate a more user friendly design

Investors and Non-Investors can visit the redesigned website at: https://www.globalsharesfund.co.nz and our current portfolio holdings at: https://www.globalsharesfund.co.nz/portfolio

What We’re Reading - Lockdown Edition.

Bitcoin and Other Bubbles.

Video/Podcast: Financial historian James Grant talks about interest rates, the “central pricing mechanism for financial markets” have been pushed to artificially low levels by the Fed’s policies which have created numerous market bubbles. He cites Bitcoin as one of the most extreme examples.

An interview with "Cable Cowboy" - Dr. John Malone.

Podcast: Dr. John Malone is now the United States' largest land-owner. Malone is also chair of media conglomerate Liberty Media - which investors in the Elevation Capital Global Shares Fund own.

Highlighting Farfetch

Not Farfetched - luxury clothing retailer returns 328.58% for the Global Shares Fund.

Investors in the Elevation Capital Global Shares Fund owned shares in Farfetch Limited [FTCH.NYSE], an online luxury clothing marketplace that connects iconic brands including Richemont, Givenchy and boutique Australasian designers such as Maggie Marilyn (NZ) and Aje (AUS), to consumers globally.

On 5 November 2020, Farfetch, Alibaba Group, Richemont (both also holdings in the Elevation Capital Global Shares Fund) and Artémis (the parent of Kering) announced a global strategic partnership to provide luxury brands with enhanced access to the Chinese market place. This partnership was the catalyst for Farfetch to experience a rapid re-rating of +153.62% in Q4 2020.

We identified the potential for Farfetch to disrupt the fashion industry when we first acquired shares in February 2021 post a disappointing IPO and the subsequent acquisition of New Guards Group (owner of Offwhite and Opening Ceremony) which the market didn’t appreciate at the time.

Given the rapid appreciation in Farfetch’s stock price it has now surpassed our appraisal of intrinsic value and we divested generating a +328.52% return for fund investors.

Farfetch now resides on our long-term watchlists awaiting “Mr. Market” to present us with an opportunity to potentially reacquire this truly disruptive company at a discount to intrinsic value once again.

New Zealand Rural Land Company Listing

On 21 December 2020 at 11:30 am, New Zealand Rural Land Company (NZL:NZX) listed on the New Zealand Exchange (NZX). NZRLC is the first agri-REIT on the NZX, offering investors the opportunity to own a stake in one of our country's most important assets, rural land.

NZRLC would like to once again, extend thanks to those who supported the company through its Initial Public Offering.

Follow New Zealand Rural Land Company on LinkedIn for important information and updates regarding NZRLC's progress.

NZRLC Successful IPO

New Zealand Rural Land Company (NZRLC) is pleased to announce the closure of a successful Initial Public Offering having achieved its minimum raise condition of $75 million.

NZRLC will be listed on the NZX on Monday, 21 December 2020 under the ticker [NZL:NZX].

The Board of NZRLC thanks investors for their support and endorsement of our long-term vision.

https://nzrlc.co.nz/

November 2020 - Our Best Ever Month

The Elevation Capital Global Shares Fund has achieved its best one-month return since inception.

This brings the Fund’s total return to +34.49% financial year to date, +9.45% for the calendar year and +6.38% per annum since inception (all returns are net of fees, expenses and taxes within the Fund).

Mastercard - Synonymous with Growth

Investors in the Elevation Capital Global Shares Fund own a share of Mastercard Inc. [MA], a global facilitator of payments. The Fund added Mastercard as well as Visa to the portfolio during the market sell-off in March 2020 as we identified an opportunity to diversify our holdings into one of the fastest-growing industries, digital payments. The use of cash is declining while e-commerce and digital wallets are on the rise aided by the proliferation of smart-devices and improved offerings by companies like Amazon and Shopify. Mastercard is well-positioned to capture the long-term increase in payment flows through its financial ecosystem as a result of changing consumer and business behaviour. To read our summary report please click here.

Invest in something new… New Zealand

Yesterday, the RBNZ Governor talked about the need to deepen capital markets and offer New Zealand Investors alternatives to residential property investment.

The Initial Public Offering (IPO) of New Zealand Rural Land Company (NZRLC) achieves both these goals by offering New Zealanders the chance to invest in a NZX listed company providing capital to the backbone of our economy - the agricultural sector. NZRLC plans to invest in New Zealand rural land offering 10-year leases to food producers and removing, for investors, direct exposure to commodity price fluctuations and on-farm activities by being a landlord only.

NZRLC is a unique opportunity to invest in what will be New Zealand's (and the NZX's) first Agri-Listed Property Company.

To find out more about this opportunity, please visit https://www.nzrlcshareoffer.co.nz/ and read the Product Disclosure Statement.

This IPO offer closes at 5:00pm, 11 December 2020.

NZRLC - NZ Herald Feature

New Zealand Rural Land Company (NZRLC) upcoming IPO - featured in NZ Herald today - read the full article here.

Fund Update: Farfetch

Investors in the Elevation Capital Global Shares Fund also own shares in Farfetch Limited [FTCH], a global digital marketplace that connects brands, retailers and consumers which integrates delivery partners from around the world.

On 5 November 2020, Farfetch, Alibaba Group, Richemont (which the Fund also owns) and Artemis announced a global strategic partnership to provide luxury brands with enhanced access to the China market place and further accelerate the digitisation of the global luxury industry. By leveraging each company’s respective expertise and reach, this partnership represents the next step in achieving the integration of online presence and in-person retail necessary to remain at the forefront of the luxury goods industry.

Farfetch will launch luxury shopping channels on Alibaba’s platforms, Tmall Luxury Pavilion and Luxury Soho expanding Farfetch’s global luxury platform to Alibaba’s 757 million customers offering luxury brands a multi-brand solution through a single integration with Farfetch enhancing brand awareness. For consumers, this partnership represents an expansion in options to shop for their preferred brands.

Christian Dior - LVMH at a Discount

Investors in the Elevation Capital Global Shares Fund own shares in Christian Dior SE [DIOR.PA], a French based holding company that controls a 41% interest in Louis Vuitton Moet Hennessey (LVMH). In 2017, LVMH acquired Dior (the fashion house) from Christian Dior SE in a US$13.10 bln deal, consolidating LVMH’s fashion offerings which is today the largest luxury goods conglomerate in the world

The luxury goods industry, like many others, has been hard hit by COVID-19 in 2020 with all industry leaders anticipating a loss of profits caused by the closure of stores and restrictions on tourism. Given the capacity and agility possessed by Christian Dior / LVMH, we have few concerns about the reductions in earnings having longevity and negatively affecting the business over the long-run. The companies operate in a unique position within the luxury goods industry having successfully employed a vast vertical integration model and diversifying its revenue streams on a global basis that positions the company to flourish once a “new normal” is established.

To learn more about why we believe Christian Dior represents a compelling long-term investment opportunity for the Fund, please click here.