Visa, Mastercard, and the blockchain

Source: Howmuch.net

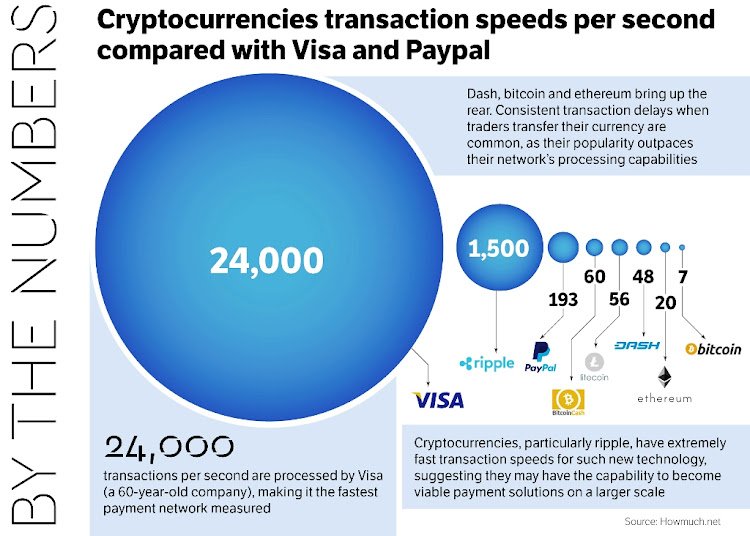

We had a few erudite replies to our recent blog post on Visa and Mastercard, a number of them which concerned blockchain and Bitcoin; we thought it might be constructive to further detail why Visa and Mastercard’s transaction processing speed (TPS) is by order of magnitudes faster than anything on the blockchain currently, and why we see this as a significant competitive advantage for the foreseeable future.

Blockchain, of course, is the overarching protocol which is used by cryptocurrencies like Bitcoin. If Bitcoin is a currency, then blockchain is the infrastructure which allows it to flow from place to place. It is the obvious direct competitor to Visa and Mastercard’s own infrastructure. Traditional payment infrastructure requires a third party to verify the transaction (Visa, Mastercard and so on). Blockchain verifies transactions in a decentralised manner, via multiple miners who then complete “proof of work” to verify the transaction. This burden of “proof” is spread across many thousands of miners, hence the decentralisation.

Blockchain is an attractive protocol and proposition as a “source of truth” for documentation which has typically been hampered by bureaucracy. An example might be property records and the transfer of them, which are typically routed through government departments and are reliant on protocol and processes which are often slow and inefficient. Yet blockchain’s transaction speed still pales in comparison to Visa and Mastercard’s own networks -- the most well known cryptocurrency, Bitcoin, can process about 7 transactions per second. Visa’s network can process up to 24,000 per second. Other cryptocurrencies can process more transactions per second: Ripple can handle up to 1500, though the vast majority process in the low double digits (Ethereum can process up to 25 per second). The relative difference in processing speed is due to scalability. Real estate transactions occur less frequently than everyday transactions, so the issue isn’t a problem for blockchain to handle. Yet in the context of transaction processing for everyday payments the problem of blockchain’s scalability is significant. Visa and Mastercard can process more transactions by an order of magnitude.

The scalability problem

The scalability of Bitcoin and most other cryptocurrencies is related to block size. On average, a new block is mined every ten minutes by Bitcoin miners, which averages at about 4.6 transactions per second. With bitcoin, the two variables which dictate transaction speed (TPS) are block generation time and block size. Block size is currently hard coded at 1MB, while block generation time can be reduced by reducing the complexity of the hashing puzzle used to create new “blocks”. In other words, there are two levers: size and complexity. This is often referred to as “the blockchain trilemma”.

On average Visa processes +1,700 TPS. To achieve that average TPS in bitcoin, the entire system would would need to be scaled by 377x. This could be achieved either by increasing the block size to 377 MB (remember, it’s only one MB right now) or increasing the block generation time to 1.5 seconds (the average is 10 minutes), or by a combination of the two. The challenge is significant. There are possible solutions to the scalability problem; parallel proof of work (ie. engaging in the same “proof of work” from multiple miners) or incorporating multiple transactions into the same batch (which reduces the size of the total transactions by about 5.5x). “Batching” transactions is efficient, yet Bitcoin limits this -- transactions from multiple wallets cannot be batched.

This is partially why we believe that Visa and Mastercard’s dominance of global payments and transactions will continue: the scalability problems of blockchain are significant. Visa and Mastercard’s TPS is lightyears faster than anything currently offered by the blockchain, which should stand up as a durable competitive advantage in the business Visa and Mastercard dominate - everyday payments - for many years to come.

Sources cited:

Diana Chen -- Understanding the Scalability Issue of Blockchain