How do wars and crises affect equities? Some counterintuitive data.

There is little point in beating around the bush. Stock markets have been subject to heightened volatility. The short-term results aren’t pretty. Even “value”-orientated portfolios have been subject to “market forces”.We are constrained by our mandate – we cannot short (and would not want to anyway) or engage in derivatives. This is most likely a good thing if history is any guide – the investor who invested their portfolio into US equities on the eve of WWI would’ve seen their portfolio rise, on average, ~47% between 1914 and and 1923. A similar scenario occurred during WWII – UK equities outperformed gold from 1939-1948. In other words: hedging and derivatives might window-dress returns in the short-term but in the long-term a diversified equities portfolio delivers a more than satisfactory return.

The volatility is due to Ukraine. As of writing Putin has engaged in a full-scale invasion of Ukraine. The US and its NATO allies have responded by imposing sanctions on Russian banks, and have restricted Russia’s sovereign debt and trade apparatus. Germany halted the pipeline Russia was building to transport natural gas; to which former Russian president Dmitry Medvedev tweeted “welcome to the new world of expensive natural gas, Europe!”

Biden’s sanctions are typical of the US. They cause the greatest harm to Europe (the US has ample natural gas pipelines). They aren’t an incentive for Putin to cease invading Ukraine – the harm caused by cutting off Russia’s vast natural resources has a greater effect on the rest of the world.

The good news is – history suggests that holding (and adding to) equities during a war still results in outperformance against all other asset classes.

We do not know what the future holds but we can look to history for what markets do in times of crisis. For instance, if you were to invest in the Dow Jones at the start of WWI (1914) and hold until the end of the war (1918), your compounded returns would’ve been about +8.7% per annum; or +43% total return.

If you were to do the same with US equities in WWII, your compounded return would have been +7%. If you held UK equities rather than gold in WWII (the equities of a nation crippled by WWII) you would’ve handily outperformed gold, a traditional safe-haven asset.

We recently read David Lough’s “No More Champagne: Churchill and his Money” (spoiler alert: Churchill was a world-class statesman and a world-class spender). Churchill flitted around with equities in WWI and at the outbreak of WWII; he was always looking for the “next big thing” and selling his previous holdings - often at a loss. If only Churchill had simply held a basket of equities for the duration of either war!

What about conflicts of more recent times? During the Korean War (1950-53) the Dow delivered an astonishing +16% return annualised, whilst during the Vietnam War (a prolonged, messy and expensive conflict if there ever was) the Dow delivered a return of +5% annualised. Two months after 9/11 the stock market returned to pre-9/11 levels.

The commonality throughout all these conflicts and wars is that volatility was priced-in early on. The anticipation of conflict caused a sharp drop in market indices, whilst the first month or two of said conflict led to panic selling as market participants adjusted to new information, as illustrated in the chart below:

Source: AMP Capital

A few interesting points to be made, then. The first is that the more serious and involved the war the longer the market takes to resolve itself - but it does resolve. In a diplomatic crisis (i.e. Cuba) the market resolves itself hastily. Even the Iraq war – an event over which an endless quantity of ink has been spilt - resolved itself with comparative speed in the eyes of the US equities markets.

S&P 500 and associated wars and crises

Source: Investmentoffice.com

Another compelling case for investment in equities (in other words, assets that earn capital in very real terms) comes from examining the S&P 500 since during several major wars and crises. The index has steadily maintained its upward incline in the face of wars and crises. This is no secret. The benefits of indexes or being fully invested in equities have become dogma - it is clear for all to see - yet it is remarkable how this wisdom is forgotten in times of war and crisis.

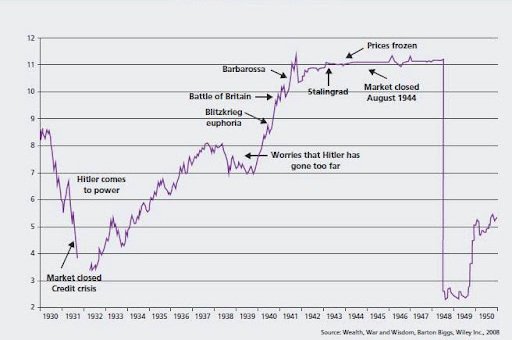

Charlie Munger likes to say “invert, always invert” - so it’s interesting to look at the flipside of WWII, from the perspective of not the US or UK equity markets but those of the eventual loser of the war – Germany. How did they fare?

German CDAX Index: 1930 - 1950

Source: Wealth, War and Wisdom (Barton Biggs)

The results are interesting – the German CDAX (an index of all stocks listed on the Frankfurt stock exchange) reacted very much the same to WWII as the Allied powers did. It suggests that market participants in a war react the same to material news regardless of which “side” they are on: all is fair in love and war. The other remarkable thing is that post-WWII German stocks recovered relatively quickly - by 1950 German equities were unscathed by one of the most terrible wars in history.

German CDAX Index: 1840 - 2010

Source: CDAX

Of course, nobody knows the future. Yet what is clear from the current Russia-Ukraine conflict (and the accompanying response from the US, the Eurosphere and Anglosphere) is that a high amount of volatility has already been priced in. If history is any teacher, high quality equities (real companies which generate actual earnings) remain the best way to take part in the economic success story of the world.