VALUE FUND - THIRD QUARTER REPORT

Important note to our investors and other readers: Elevation Capital’s Quarterly Investor Reports are designed to inform our investors about recent portfolio developments and provide our views of the market environment. Our reports are not investment recommendations for the general public. Please read the disclaimer at the end of this document in its entirety. Elevation Capital Management Limited (as Manager of the Elevation Capital Value Fund) may also trade in and out of any position discussed and undertakes no duty to update anyone, except to the extent we are required to make filings with any market regulator. Investors who chose to take action based on our investment ideas do so at their own risk.

Fund Review

The global equity markets marched on in the third quarter, but unfortunately so did the NZ Dollar, which appreciated +7.85% versus the US Dollar. Short-term currency movements aside the Fund remains extremely well-positioned with a portfolio of wide-moat companies and special situations. Our cash balance at the end of Q3 2013 was +24%, which continues to highlight our conservative positioning.

Given the continued appreciation of markets it is not unreasonable to expect (subject to inflows/outflows and further new idea generation) that our cash balance may increase as we prudently realise gains on selected positions (e.g. Chesapeake Energy, Staples Inc.)

Below we have detailed the five largest contributors/detractors from Fund performance during Q3 2013:

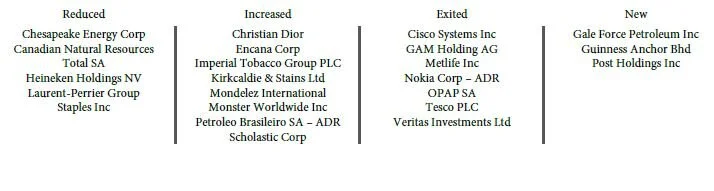

During Q3 2013 we undertook the following portfolio movements:

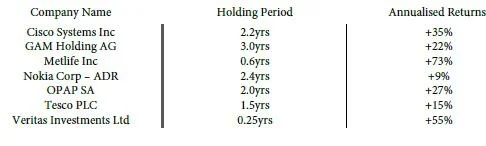

All positions we exited were profitable. Detailed below is a brief overview of the results:

In terms of new investments or increases to existing holdings during Q3 2013 the Fund was active to varying degrees in the US, UK, France, Canada and Malaysia.

One investment, where we added to our position, which we would like to cover in further detail for investors is: Mondelēz.

Mondelēz was the international business of Kraft Foods Inc. Its key brands are:

Mondelēz’s business is growing rapidly within the emerging markets and they continue to invest in their global infrastructure.

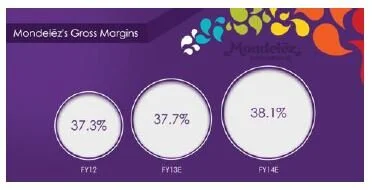

This is translating into attractive earnings growth:

But, and there is always a ‘but’ with stocks we are purchasing (it is the very nature of value investing) ...

Mondelēz has a lower gross margin of 37.3% compared to the industry average of 39.4%. (The industry average comprises figures from Mondelēz, The Hershey Company, Kellogg and General Mills for the purposes of this comparison).

Herein lies the crux of the investment thesis. Mondelēz’s profit margins are below peers and the management is poor. Warren Buffett was less than complimentary on the CEO Irene Rosenfield when she sold a Pizza business to Nestle as part of the Cadbury acquisition in 2009/2010. We also heard the CFO of Mondelēz present this year at an investor day and we were less than impressed. In fact, we came away from that presentation wishing we had the capital to undertake an activist position ourselves but with little doubt that it was only a matter of time. It should therefore come as no surprise that Mondelēz is now the target of activist billionaire investor – Mr. Nelson Peltz. According to Barron’s, Mr. Peltz recently presented on Mondelēz and did not mince his words. He finds the company poorly run (with which we concur) despite its roster of great brands. Mondelēz 's cost structure, whether selling, general, and administrative costs or inflated working capital levels, is bloated compared with peers, according to Mr. Peltz. As a result, its operating margins are a mere 12% compared with the 18% it could garner with a modicum of operational changes. Mr. Peltz has already made his views known to a few directors of the company, but a fuller patented assault impends. Mondelēz should be able to double earnings per share by 2015, he says. He even wants to dump the odd company name. It sounds too much like a medicine, he says.

We welcome the pressure Mr. Peltz is placing on the management and any value creating initiatives he can bring to the table. Mondelēz is now one of the largest positions in the Fund and we believe it is well placed to potentially be one of our best performers in 2014.

Firm Update

We would like to officially welcome Richard Milsom to Elevation Capital Management Limited as a full-time addition to the team. Richard has already made a large impact by recreating our website and new fund / presentation documents – please visit www.elevationcapital.co.nz to view the improvements yourself.

We also have another new intern – Sam Weir. Sam is completing his Masters Degree at Massey University and is currently scheduled to work with us until late 2014. Sam has had some interesting international experience to date having been a journalist before his return to University in New Zealand. Please find detailed below links to two articles which Sam authored (one under a pseudonym for safety reasons) and which were published in the Guardian and In These Times.

In Closing

The Fund remains well-positioned heading towards year-end with a robust cash balance that continues to afford opportunity. We are already planning for 2014 and potential areas of interest. We have one international stock exchange which is on our potential target list, and we are undertaking some initial due diligence on a major ASEAN market to investigate certain stocks within this market so we are prepared for if/when “tapering” does arrive, that we are well- positioned to potentially capitalise on opportunities that may well be thrown up as investors overreact to short-term events and overlook long-term fundamentals.

The stock exchange we referred to above is an idea formed from reading a small article in the print edition of the Wall Street Journal, which we have delivered to the office usually two - three business days after publication. This idea cannot be executed tomorrow and we have to wait for a specific event. However, the reason we highlight this to you is that being on the other side of the world is not a disadvantage. New investment opportunities are available, the key is to have the time to sit quietly, think and then act. People love to create “noise” in the investment business. We truly believe we are at an advantage when investing internationally because we can ignore this “noise”. The famous international investor, Sir John Templeton once commented that an advantage of living in the Bahamas was he received the Wall Street Journal a day late and therefore did not get caught up in the mood of the day. With the Wall Street Journal arriving two - three business days late to Parnell, Auckland we have little chance of being caught up in the “noise”.

We look forward to seeing many of you on the 14th November 2013 (6pm) at the Holy Trinity Visitor’s Center (cnr St Stephens Avenue and Parnell Road) to celebrate 5 years of the Elevation Capital Value Fund. (I would also like to personally assure you all, I will only present briefly on one new investment – POST Holdings Inc., before Matthew Hooton provides his insights into the New Zealand political landscape entering 2014.) If you have not yet RSVP’d please send to: admin@elevationcapital.co.nz

Yours Sincerely,

Elevation Capital Management Limited