ELEVATION CAPITAL - FOURTH QUARTER REPORT

Dear Fellow Unitholders,

Global markets have continued to rally well into the New Year with the Dow Jones Industrial Average only this past week breaking through 12,000 a level not seen since September 2008. Markets are being driven by an economic recovery that is now clearly underway in the United States greatly assisted by monetary easing provided by the Federal Reserve. This has resulted in significant rallies in all asset classes except US Treasury bonds (which we have cautioned about in past reports). Asset classes rallying include equities, commodities and commodity currencies (eg. the Australian Dollar, the Canadian Dollar and the NZ Dollar) on a worldwide basis.

The markets are now referring to the Federal Reserve’s Quantitative Easing Program/s collectively as the “Bernanke Put” as the Fed Chairman seems very focused on the wealth effect that a higher stock market will have on the US consumer. Mr. Bernanke recently appeared on 60 Minutes in the US and stated that he was convinced that the Fed’s policies “were contributing to a better outlook for the economy” and that he remained “100% certain” the Fed could control the inflationary impact (if any) of its current policies.

It remains difficult to predict the outcome of any/all of these policies and Mr. Bernanke’s comments. One could also view Mr. Bernanke’s sudden clairvoyance with a healthy degree of skepticism as the future is always uncertain. Our job is not to spend hours trying to forecast macro-economic variables and their every machination, rather it is to build portfolios with an opportunity set which is attractive on a long-term risk/reward basis with an ever present margin of safety.

Therefore, we have continued to put in place the foundations of what we believe will deliver both improved returns in the Elevation Capital Multi Strategy Fund with lower volatility and continue to provide steady conservative returns inthe Elevation Capital Value Fund over the long term.

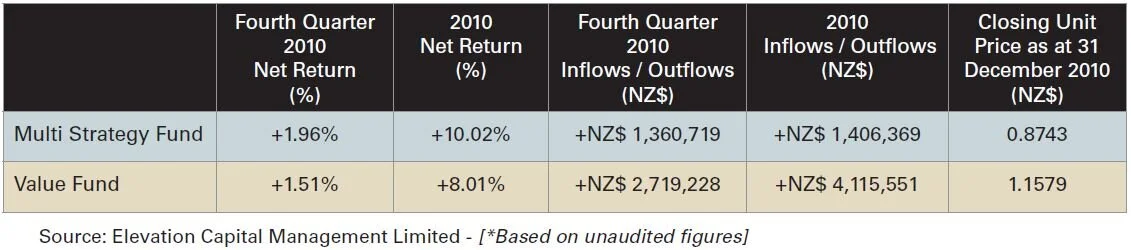

The Funds key performance data and inflow/outflow data as at 31 December 2010 is as follows:

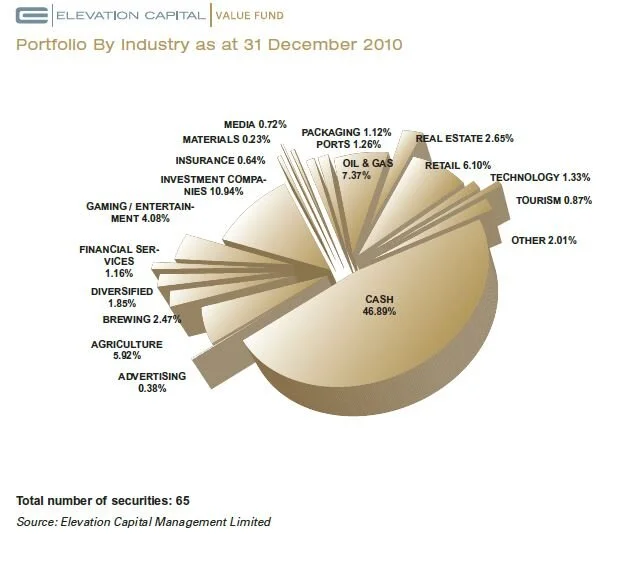

Both Elevation Capital Funds took advantage of the markets continued strength to opportunistically divest some positions and reinvest/build cash positions during Q4 2010.

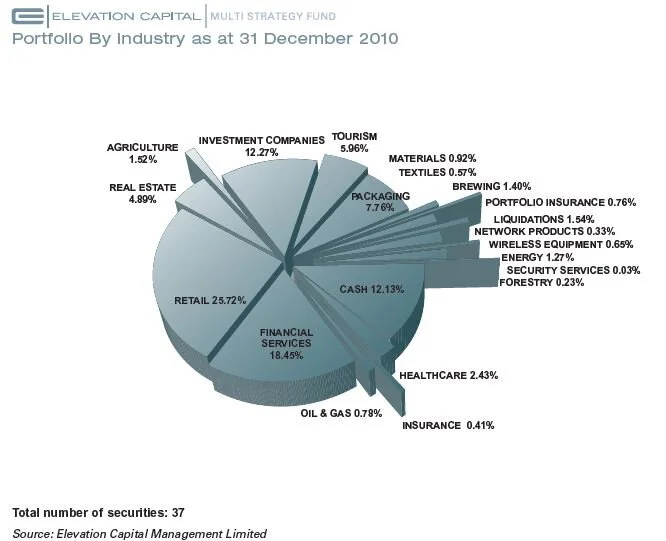

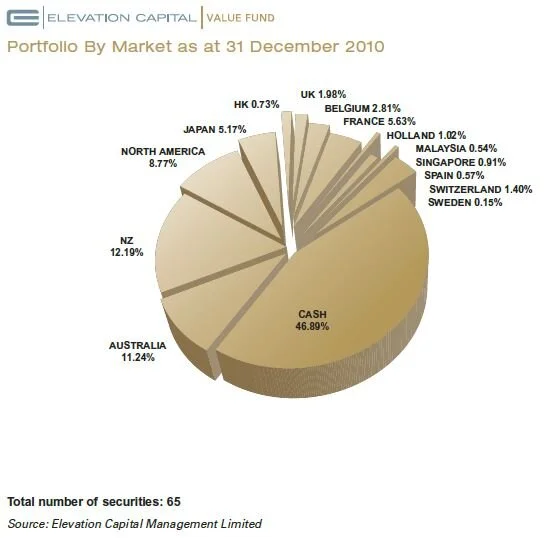

While the names detailed below may seem disparate we continue to find new and undervalued opportunities in both Continental Europe and Japan (particularly for the Value Fund). This is clearly reflective of the widespread negative sentiments to these markets at present. Despite this negativity the value on offer is hard to ignore with many of these companies presenting investors the chance to acquire strong global franchises backed by conservative balance sheets and consistent dividend track records at sizeable discounts to even the most cautious appraisal of intrinsic value.

Artio Global Investors (Artio) we added a small position after visiting the company in New York in December. Artio is a global asset management company, which offers a range of investment strategies, including High Grade Fixed Income, High Yield, Global Equity and US Equity strategies. The growth of Artio is an extraordinary story with long serving management who have established an impressive track record. Artio was established out of the US asset management division of Swiss Private Bank – Julius Baer. In roughly 1995, the present management took over a Julius Baer fund which contained ~US$ 8mln of investor funds and not the best track record. Over the next 15 years, the current management produced robust long-term performance by following an active value approach. Assets under management (AUM), today stand at +US$ 50bln. As is always the case at particular points in time the company’s core equity funds (which account for a majority of the AUM) have run into a period of underperformance and as a result Artio has seen some outflows. Artio completed an IPO on the NYSE in September 2009 and floated its common stock for US$ 26.00 per share. Given the recent underperformance and outflows investors have become despondent with the stock and afforded us an opportunity to acquire Artio shares on very attractive long term metrics – a single digit Price-to-Earnings ratio and by our calculations a +45% discount to its asset management peer group. It is also trading at a sizeable discount to industry standard calculations from an asset sale/cash liquidation perspective. While many asset management businesses are exposed to the potential loss of valuable human capital, the current management of Artio continue to hold large amounts of stock (with restrictions) and have a strong alignment of interest to - (i) improve performance or (ii) sell the company. (At the time of writing, Artio was trading at US$ 14.80 per share and accounted for 0.48% of our Net Asset Value.)

CBS Canterbury (CBS) & Southern Cross Building Society (SCBS) completed their merger with MARAC to form Building Society Holdings (BSH), which listed on the NZX on 1 February 2011. This was a very pleasing outcome albeit there is still a large amount of work to be done to achieve bank registration. We remain positive on the long-term outlook for BSH and the opportunity to prudently carve out a niche within the NZ banking system. The management team is led by Jeff Greenslade who is ex-ANZ Bank and a very experienced banker. We have expressed our commitment to remain a long-term shareholder of BSH to Jeff, as we believe in the strategy that has been articulated and the opportunity set in front of the company. We will keep you updated on BSH’s progress. (At the time of writing, BSH is our single largest position at +15% of our Net Asset Value.)

Kirkcaldie & Stains (KRK) & Smiths City Group (SCY) are both significantly undervalued companies that have recently received letters from Elevation Capital requesting each company consider ways to realise value for their respective shareholders. In each case, we are awaiting responses from or meetings with the Board and management executives. In respect of both companies, we now hold the view that we have exhibited enough patience and it is time for some action. Neither company can maintain the status quo indefinitely, and we feel it is our responsibility to make 2011 a year where we step up pressure on Boards in an effort to realise value for allshareholders, but most importantly our unitholders. Please click on the following link to read our letters dated 1 February 2011 to KRK and 30 November 2010 to SCY - www.elevationcapital.co.nz/newsroom/letters. We will keep you updated on our progress. (At the time of writing, KRK accounts for 4.69% of Net Asset Value and SCY accounts for 3.03 % of Net Asset Value. *Note: the Value Fund also holds a position in KRK which accounts for 1.81% Net Asset Value.)

Satara Co-operative Group (Satara) received a takeover offer from EastPack Co-operative at NZ$ 1.25 per share during Q3 2010. To say we were pleased to have a bid on the table was an understatement. Satara has been the source of much frustration for us in the past as the former chairman of the company and the management team ignored our calls for a suspension of expansion capex and requests to engage in industry consolidation on numerous occasions. Finally, it took the leadership of a new Chairman Hendrik Peters and a new Managing Director Tom Wilson to bring Satara to the negotiating table, striking a merger deal with Eastpack – they did a stellar job for the growers and the investor shareholders and should be commended.

Unfortunately, ~35 days into the takeover/due diligence phase – the kiwifruit industry was hit with news that the potentially devastating vine virus PSA (Pseudomonas syringae pv. actinidiae) had entered New Zealand. Not surprisingly, and understandably (in our opinion), Eastpack sought to re-negotiate the deal. During November 2010 we had meetings with Eastpack to try and help negotiate a revised takeover for Satara – Elevation Capital and two other major shareholders even offered to provide financing to Eastpack to enable completion. Despite our best efforts Eastpack decided not to complete a takeover of Satara, which is clearly very disappointing.

The one positive outcome of the transaction was that Satara did divest a key property asset and used the proceeds to reduce its debt by ~50%. At a time of such uncertainty, it is pleasing to have an investment in an agricultural exposed company, which is financially robust. Our investment is by no means a write-off as a result of PSA and there still remains significant value in the infrastructural assets that Satara owns. PSA has not affected Satara’s crop supply in a significant manner to date and crop volumes/throughput are expected to be ahead of last season as the company regains market share. We plan to re-engage with the management and board of Satara very soon to look at a further restructuring of the company with the ultimate goal of improving operational performance, and potentially returning the company to grower ownership, which we believe would be in the best interests of the growers and investors in the long term. As always, we will keep you updated. (As at the time of writing, Satara accounted for 3.48% of our Net Asset Value based on a NZ$ 0.45c carrying value.)

Ciments Français SA (CMA) is a French company which produces cement, aggregates and ready mix concrete. The company operates in 19 countries including - France, Belgium, Spain, Bulgaria, Morocco, Eqypt and Thailand among others. CMA is 82.53% owned by Italcementi (ITA).

In February 2009, CMA and ITA contemplated a merger but this was abandoned in June 2009 because debt holder demands at the time were deemed excessive. In April 2010, CMA launched a tender offer for its debt and nearly all the debt (excl. €16.5mln) out of €500mln was tendered for repurchase. This has clearly removed a significant impediment to an eventual merger with ITA. Additionally, ITA would like to access CMA’s strong free cashflow (free cashflow is the amount of cash that a company has leftover after it has paid all of its expenses, including investments) and its balancesheet CMP’s free cashflow and it’s yield is an impressive 22%.

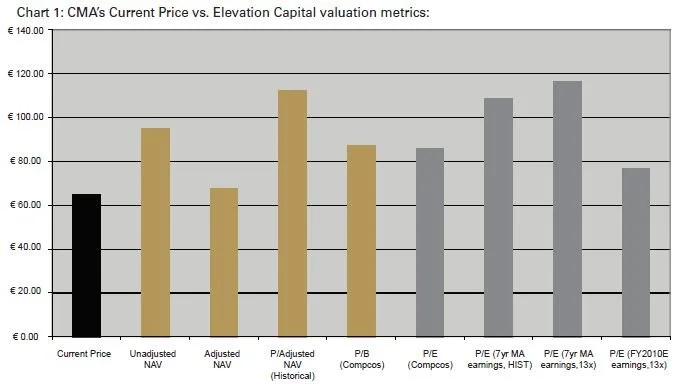

Putting aside the possibilities of a merger with ITA, CMA is very cheap on a number of metrics, including Price-to-Earnings and Price-to-Book. The valuation metrics we used to appraise CMA are detailed below – one can see across all measures with which we appraised CMA that the company is undervalued. (It should be noted our Adjusted NAV is our most conservative valuation metric and in this case it impairs all intangible assets on the balance sheet to zero – an approach we feel provides us with a significant margin of safety.)

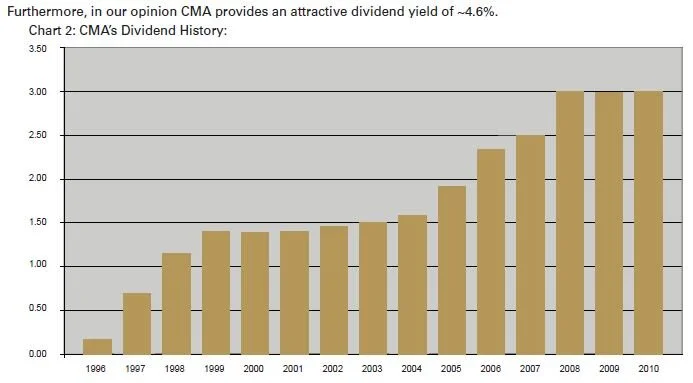

CMA strikes us as an investment with a large margin of safety given its financial strength and despite the depressed environment for building materials/aggregates, it also offers the potential for significantly improved profitability if economic conditions ameliorate. We also received (in our opinion) a “free option” on potential corporate activity at some point in the future based on previous attempts by Italcementi to consolidate CMA. Fortunately, for the Value Fund, the unrest in Egypt recently afforded us the opportunity to increase our position in CMA [and initiate a small position for the Multi Strategy Fund]. (As at the time of writing, CMA accounted for 1.03% of Net Asset Value in the Value Fund and 0.19% of Net Asset Value in the Multi Strategy Fund.)

Closing Remarks

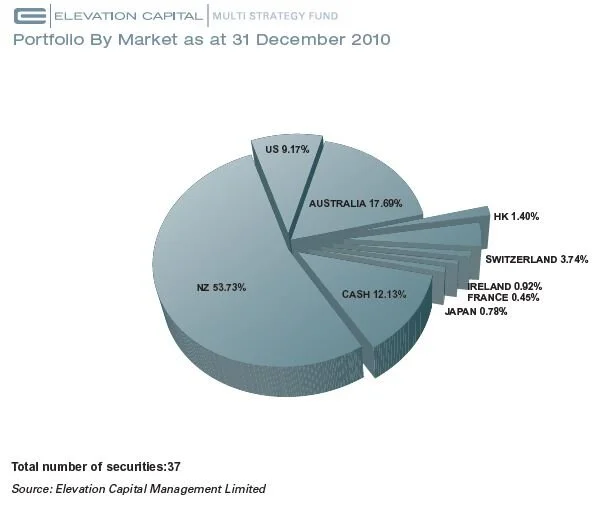

Both Elevation Funds remain very well positioned at present. The Multi Strategy Fund has in excess of 20% cash at the time of writing, the best liquidity profile in two years, and remains unhedged. We expect to be able to capitalise on more opportunities and continue to deliver improved performance in the months/years ahead. The Value Fund has in excess of 40% cash at the time of writing.

Going forward with their respective cash balances, the Funds have a large amount of option value and ballast for any periods of market weakness. Despite some suggestions that the markets are looking expensive we continue to seek out new ideas using what one could describe as our “investigative” research approach.

Our valuation frameworks have become more robust over the past four years as have our requirements around the “margin of safety” we seek in investments. For a small organisation we cover a large amount of ground

including meetings/conference calls with managements all over the world. We currently cover in excess of 75 new companies globally per annum. It is important to understand that we do not utilise any broker research models as we have developed our own templates/criteria. Our process continues to evolve and we expect it will never cease to evolve. Unfortunately, no process can completely eliminate the chance of human error. However, we continue to believe the metrics/requirements we have for investments provides us with a margin of safety where the likelihood of “permanent capital loss” is greatly diminished.

To assist in our investigative research process we have recently appointed a new research assistant – John Tsai. We first met John while assisting the Massey University Student Investment Fund in 2009 where he was a Manager. John holds a Masters in Computer Science (MSc) from the University of Auckland and is currently completing his second Masters in Accountancy at Massey University.

It is also pleasing as a firm to be growing assets under management (AUM) – total firm AUM is now +NZ$21.0mln. We are also soon to launch a new Fund of Funds in Q2 2011 with NZ$ 10mln of initial capital.

To each and every investor (old and new) please rest assured that we continue to invest alongside you and therefore treat your money as we do our own.

Thank you for your continued support and interest.

Yours sincerely,

Christopher Swasbrook

Elevation Capital Management Limited