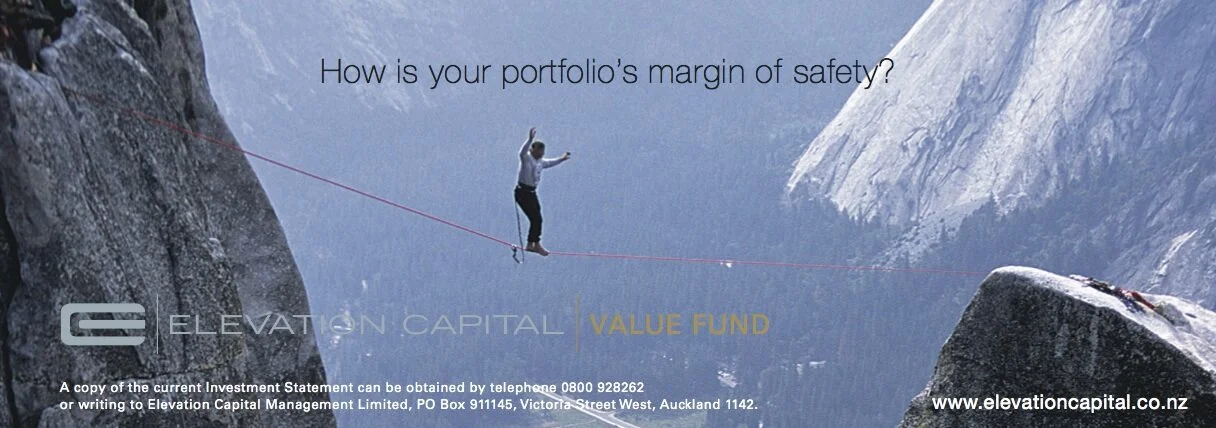

MARGIN OF SAFETY

At Elevation Capital our investments are premised on the concept of “Margin of Safety” which we believe reduces risk. What this means is we seek to acquire investments that are sufficiently cheap so that there is a margin of safety, which minimises the risk of incurring permanent capital loss. Therefore, it is unlikely you will see us investing in the “fashionable” areas of the market. The concept of “Margin of Safety” was first brought to investors by Benjamin Graham and David L. Dodd in the book “Security Analysis” the core principles of which hold true today. In determining our “Margin of Safety”, Elevation Capital typically focuses on the company’s balance sheet and cashflow generation. This coupled with research into peer companies, corporate mergers, acquisitions and liquidations allows us to assess the “Margin of Safety” on offer.