ELEVATION CAPITAL - THIRD QUARTER REPORT

Dear Fellow Unitholders,

Global markets embarked on a strong rally during Q3 2010 which continued into early Q4 as the US Federal Reserve embarked on a program called Quantitative Easing (“QE”). In simple terms, this is central banker talk for “money printing” which in turn allows the Federal Reserve to monetize US government debt. In my opinion, the whole purpose of such an exercise is to create inflation and reflate asset prices – particularly the stock market, as the authorities attempt to create a “wealth effect” to stimulate economic activity and job creation. The cartoon below from the 25 October 2010 edition (pg. 87) of The New Yorker provides an appropriate illustration of the goals (and effects) of QE.

It is difficult to know if the US Federal Reserve will succeed in achieving their goals. It is reasonable to assume that they will succeed in devaluing the US Dollar. Therefore, I continue to hold the view that being owners of profitable enterprises and/or tangible real/productive assets is one of the best ways to both protect and grow investor capital over the medium to long-term.

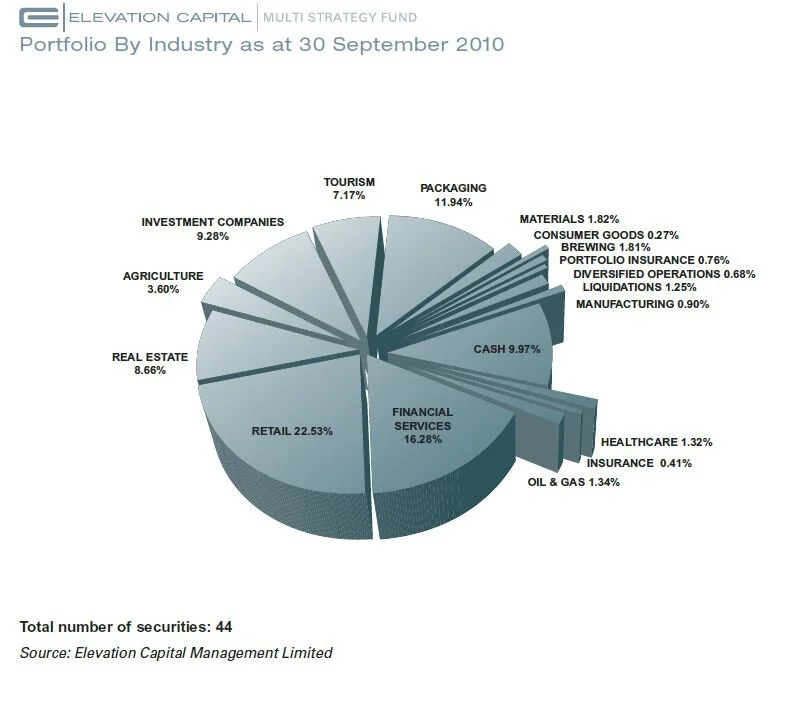

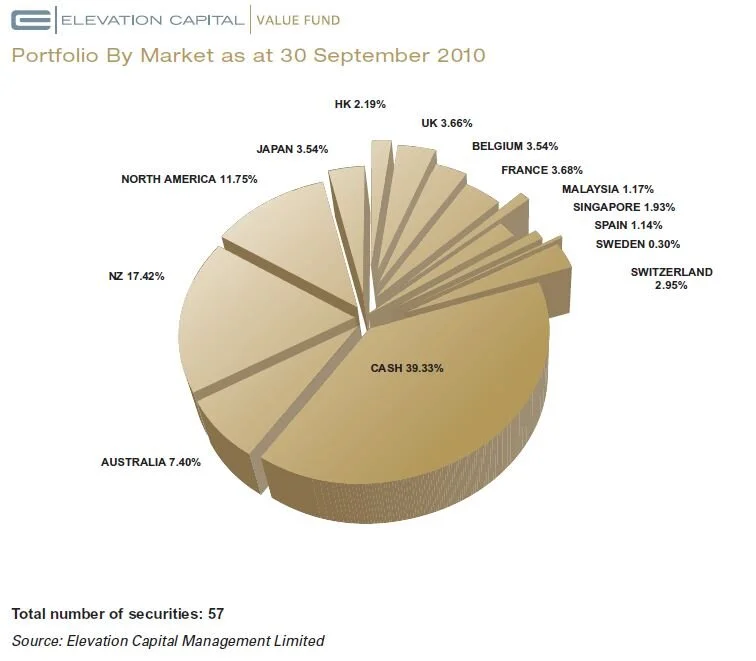

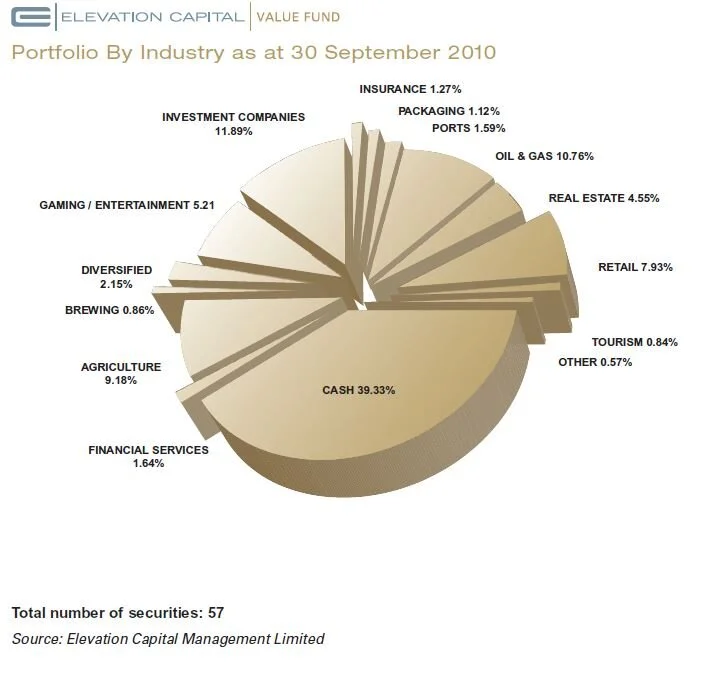

Therefore, in terms of investment focus for both Elevation Capital Funds, we have continued to acquire oil and gas companies, companies that own attractive brands that may/should be part of a larger portfolio, companies with robust balance sheets and global businesses which provide a “safe and cheap” exposure to emerging market growth and/or a variety of “special situations”.

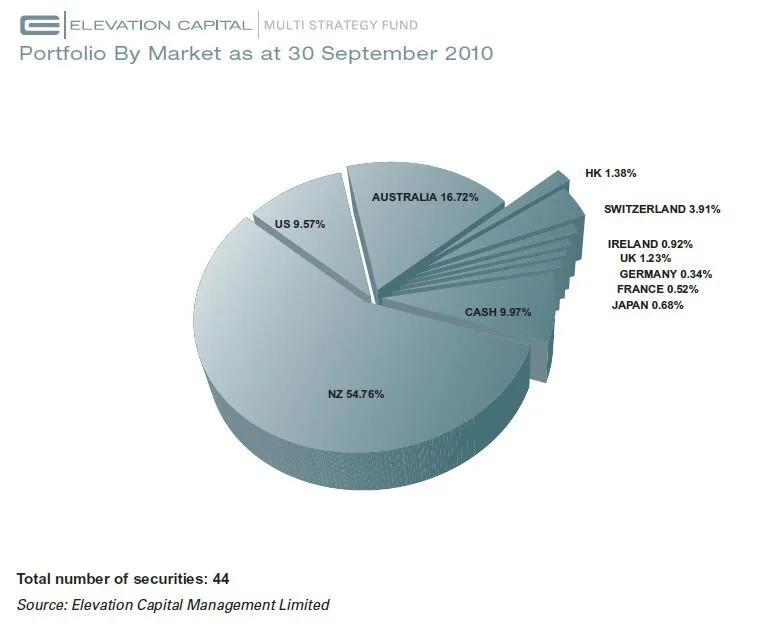

Recently, in the large cap universe, we have added stocks from Japan and Europe. In small cap’s, we have made new acquisitions in the US and added to existing “special situations” in both Australia and New Zealand.

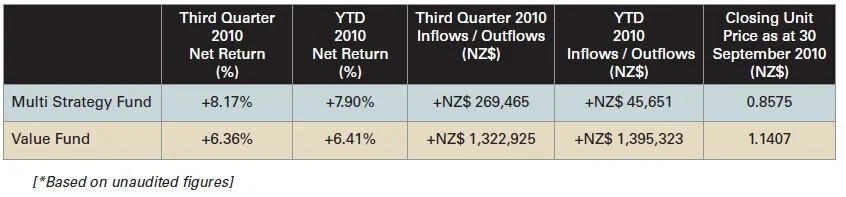

These acquisitions have been funded primarily by new inflows – particularly in the Value Fund – which has seen its funds under management (FUM) increase from NZ$ 1.25mln at the end of Q2 to NZ$ 4.5mln at the time of writing. The Multi Strategy Fund has also seen inflows recently, which has enabled this Fund to bolster its cash position and undertake some new investments.

Most importantly, both the Elevation Capital Multi Strategy and Value Funds had a sound third quarter in terms of short-term performance, as a number of our portfolio holdings became the subject/target of M&A (more on this later).All returns detailed below are net of fees:

I have previously mentioned that liquidations, mergers and takeovers would be a key theme within our Funds overtime and our current portfolio has four companies (and potentially more) which are M&A targets.

The following stocks within the Multi Strategy Fund Portfolio are now subject to merger or acquisition proposals:

Together, these investments account for 24.43% of the Fund.

While there can be no guarantee that any of the current negotiations and/or proposed transactions reach a conclusion, as one should always expect the unexpected, it is pleasing to see an acknowledgement of value or the industry consolidation potential that I first saw when I initiated our investments being recognized by either other industry participants or other sophisticated investors.

Note: Just as this letter was about to be sent the kiwifruit industry has been hit with the unfortunate news of the discovery of the PSA (Pseudomonas syringae pv actinidiae) bacteria on some vines in Te Puke. This is clearly a very negative announcement for the industry at large – albeit we do not know which strain of PSA it is. On the positive side, the Ministry of Agriculture & Fisheries (MAF) is amongst the best in the world at dealing with biosecurity issues. At this stage, the merger between Satara & EastPack is proceeding and shareholder votes are scheduled for December 2010.

I will provide further updates as documents/shareholder votes are released/completed. The following stocks within the Multi Strategy Fund Portfolio were/are subject to liquidation proposals:

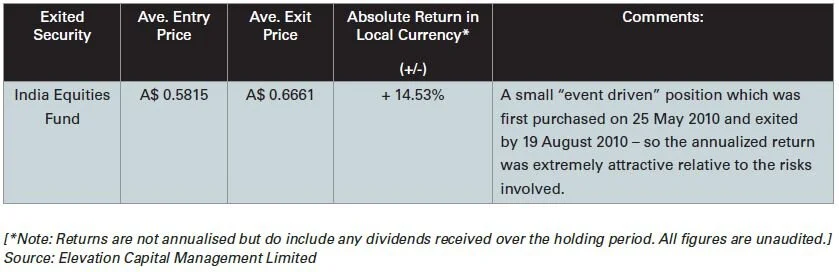

Liquidations may continue to be a lucrative area for the Fund in the future. While each has varied in their respective size within the portfolio (due predominantly to cash availability at the time), we consider the rates of return to be extremely attractive, especially when one considers the duration and risk of these investments. The investment realisations during the quarter were few:

The volatility of the market has also presented some trading opportunities for the Multi Strategy Fund as several of the companies in our portfolio have seen their stock prices by +/- 10% to 20% over short periods of time. While we are not “traders” by nature, we are willing to take advantage of these opportunities. Our portfolio turnover has risen slightly on an annual basis but remains very low by industry standards for a fund of this nature at ~30%.

The Value Fund added nine new positions during the second quarter – Callaway Golf Company (US), Cie du Bois Sauvage (Belgium), GAM Holdings (Switzerland), Great Eagle Holdings (Hong Kong), Inpex (Japan), NZ Oil & Gas, NZ Refining, St Johns Balanced Property Fund (NZ) and The Washington Post Company (US).

We also added to a number of existing positions within the portfolio when opportunities presented themselves.

The Value Fund had no investment realisations during the quarter. As a result, our portfolio turnover remains exceptionally low at ~6%.

In a positive development during the quarter, the Fund received takeover offers in the following companies:

Oyster Bay Vineyards Limited (“OBVL”) is the listed land owner of several vineyards in Marlborough which upply grapes under contract to Delegat’s who owns ~55% of OBVL. The remainder of OBVL is held mostly by a large number of small shareholders. Recently, there has been a large amount of negative press surrounding a wine glut, falling prices for our wine both domestically and internationally, as well as a number of wineries going into receivership. This has had the effect of depressing OBVL’s price on the NZAX market to levels which we felt were extremely attractive for a long term investor. While OBVL does have some debt, it was not at a level (comparing the underlying asset value and assuming a conservative appraisal of land values) that would place the investment outside of our investment criteria.

Given what I felt was an adequate margin of safety and a conservative appraisal of the underlying land values plus the importance of the asset to the parent company, we began to slowly accumulate a stake in OBVL.

Delegat’s have also sensed an opportunity and decided to capitalize on the disconnect between fundamental value and the market and launched a bid at NZ$ 1.80 per share to takeover OBVL. This bid, in my opinion, is unsatisfactory and the Elevation Capital Value Fund would not be willing to accept the current offer. To put this bid in perspective, Delegat’s values the land & vineyards at roughly NZ$ 61,000 per hectare versus the audited accounts as at 30 June 2010 which imply a valuation of NZ$ 112,473 per hectare. I admire Mr. Delegat’s desire to arbitrage the market but I would not allow the Elevation Capital Value Fund to be “arbitraged” in this manner.

While I am yet to write to the Independent Directors of OBVL on the takeover, as I am awaiting their recommendation, I would be absolutely shocked if they recommended the acceptance of Delegat’s offer. In fact, I hope they actually recommend that OBVL undertakes a deeply discounted renounceable rights issue to retire the outstanding debt and when Delegat’s are ready to offer a fair price to the shareholders of OBVL, we may entertain their offer at that point in time.

This will be an interesting test for the Independent Directors of OBVL and in my opinion, will become a case study for either the right way to act for minority investors or the wrong way to act.

Wesco Financial is an insurance holding company which is 80% owned by Berkshire Hathaway. Warren Buffett’s business partner Charlie Munger is the Chairman of Wesco. The Fund purchased Wesco in late 2008 / early 2009 in the depth’s of the financial crisis at a substantial discount to book value. Traditionally, Wesco has traded at a premium to book value because there has always been an expectation that the company would be fully consolidated by Berkshire at some point. True to form, Buffett sought to take advantage of market conditions and has bid for the Wesco minorities at Book Value. While one would not classify the offer as generous, at current levels it would represent a +30% return on the Fund’s initial cost – a more than satisfactory outcome when dividends are also taken into account.

As with all M&A transactions – I will not be celebrating until we have received any/all proceeds, should we accept any current or future offers for the Fund’s holdings.

Closing Remarks

The economic news continues to wax and wane between encouraging and discouraging. It is little wonder some investors remain confused. Many are seeking perceived refuge in gold or bonds. In my last report, I provided cautious commentary on bonds and my view has only strengthened in this regard. With regard to our equity market investments, I continue to be cautious and selective on price. This has resulted in several errors of omission within the portfolios – while these are frustrating, it is the errors of commission I am seeking to avoid and therefore I will only invest as and when appropriate opportunities present themselves – this requires a healthy amount of patience and the discipline to “ignore the crowd”.

Thank you for your continued support and interest.

Yours sincerely,

Christopher Swasbrook

Elevation Capital Management Limited